Page 87 - NIB Annual Report 12-13 | 13-14

P. 87

TURKS AND CAICOS ISLANDS NATIONAL INSURANCE BOARD

Notes to Financial Statements, continued Year ended March 31, 2013

25. Financial instruments, continued

(c) Market risk, continued

(i) Interest rate risk, continued

The long-term deposits – net, represent amounts held at TCI Bank, net of changes in fair value. While these assets were interest bearing at March 31, 2010 following TCI Bank being placed into provisional liquidation on April 9, 2010, and liquidation on October 29, 2010, interest has ceased to accrue on these amounts. For additional information on the notes receivable from TCI Bank refer to note 8.

NIB’s investment portfolio is not permitted to utilise derivatives for hedging and income enhancing strategies. Derivatives are not used to expressly employ leverage or other speculative strategies. Therefore, unless a specific type of security is allowed by the IPS, the Investment Manager must seek permission from the Investment Committee to invest in derivative instruments.

A change of 100 basis points in interest rates at the reporting date would have increased/(decreased) income in the statement of income, expense and reserves by US$521,752/(US$521,752) (2012 – US$629,726/(US$629,726)) assuming all other variables remained constant.

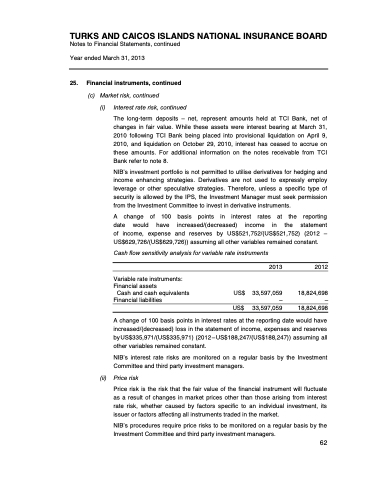

Cash flow sensitivity analysis for variable rate instruments

Variable rate instruments: Financial assets

Cash and cash equivalents Financial liabilities

2013 2012

US$ 33,597,059 18,824,698 – – US$ 33,597,059 18,824,698

A change of 100 basis points in interest rates at the reporting date would have increased/(decreased) loss in the statement of income, expenses and reserves byUS$335,971/(US$335,971) (2012–US$188,247/(US$188,247)) assuming all other variables remained constant.

NIB’s interest rate risks are monitored on a regular basis by the Investment Committee and third party investment managers.

(ii) Price risk

Price risk is the risk that the fair value of the financial instrument will fluctuate as a result of changes in market prices other than those arising from interest rate risk, whether caused by factors specific to an individual investment, its issuer or factors affecting all instruments traded in the market.

NIB’s procedures require price risks to be monitored on a regular basis by the

Investment Committee and third party investment managers.

2013 & 2014 ANNUAL REPORT | 83

62