Page 88 - NIB Annual Report 12-13 | 13-14

P. 88

TURKS AND CAICOS ISLANDS NATIONAL INSURANCE BOARD

Notes to Financial Statements, continued Year ended March 31, 2013

25. Financial instruments, continued

(c) Market risk, continued

(ii) Price risk, continued

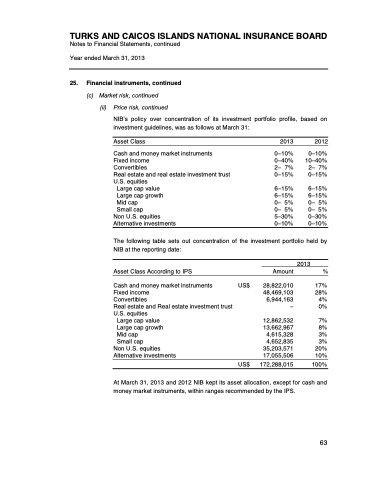

NIB’s policy over concentration of its investment portfolio profile, based on investment guidelines, was as follows at March 31:

Asset Class

Cash and money market instruments

Fixed income

Convertibles

Real estate and real estate investment trust U.S. equities

Large cap value Large cap growth Mid cap

Small cap

Non U.S. equities Alternative investments

2013

0–10% 0–40% 2–07% 0–15%

6–15% 6–15% 0–05% 0–05% 5–30% 0–10%

2012

0–10% 10–40% 2–07% 0–15%

6–15% 6–15% 0–05% 0–05% 0–30% 0–10%

The following table sets out concentration of the investment portfolio held by NIB at the reporting date:

Asset Class According to IPS

Cash and money market instruments

Fixed income

Convertibles

Real estate and Real estate investment trust U.S. equities

Large cap value Large cap growth Mid cap

Small cap

Non U.S. equities Alternative investments

Amount

US$ 28,822,010 48,469,103 6,944,163 –

12,862,532 13,662,967 4,615,328 4,652,835 35,203,571 17,055,506

US$ 172,288,015

2013 %

17% 28% 4% 0%

7% 8% 3% 3%

20% 10%

100%

84 | The National Insurance Board of The Turks and Caicos Islands

63

At March 31, 2013 and 2012 NIB kept its asset allocation, except for cash and money market instruments, within ranges recommended by the IPS.