Page 12 - Demo

P. 12

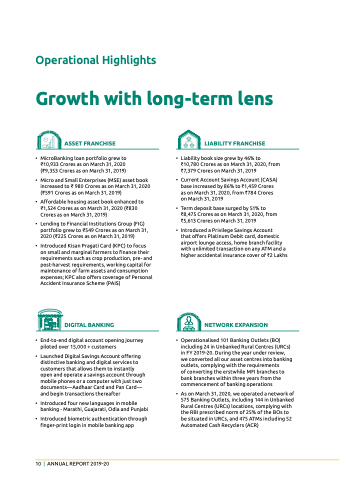

Operational Highlights

Growth with long-term lens

aSSet FRanchiSe

• MicroBanking loan portfolio grew to ₹10,933 Crores as on March 31, 2020 (₹9,353 Crores as on March 31, 2019)

• Micro and Small Enterprises (MSE) asset book increased to ₹ 980 Crores as on March 31, 2020 (₹591 Crores as on March 31, 2019)

• Affordable housing asset book enhanced to ₹1,524 Crores as on March 31, 2020 (₹830 Crores as on March 31, 2019)

• LendingtoFinancialInstitutionsGroup(FIG) portfolio grew to ₹549 Crores as on March 31, 2020 (₹225 Crores as on March 31, 2019)

• Introduced Kisan Pragati Card (KPC) to focus on small and marginal farmers to finance their requirements such as crop production, pre- and post-harvest requirements, working capital for maintenance of farm assets and consumption expenses; KpC also offers coverage of personal Accident Insurance Scheme (PAIS)

diGitaL BankinG

• End-to-end digital account opening journey piloted over 15,000 + customers

• launched Digital Savings Account offering distinctive banking and digital services to customers that allows them to instantly open and operate a savings account through mobile phones or a computer with just two documents—Aadhaar Card and Pan Card— and begin transactions thereafter

• Introduced four new languages in mobile banking - Marathi, Guajarati, Odia and Punjabi

• Introduced biometric authentication through finger-print login in mobile banking app

LiaBiLitY FRanchiSe

• Liability book size grew by 46% to `10,780 Crores as on March 31, 2020, from `7,379 Crores on March 31, 2019

• Current Account Savings Account (CASA) base increased by 86% to `1,459 Crores as on March 31, 2020, from `784 Crores on March 31, 2019

• Term deposit base surged by 51% to `8,475 Crores as on March 31, 2020, from `5,613 Crores on March 31, 2019

• Introduced a Privilege Savings Account

that offers platinum Debit card, domestic airport lounge access, home branch facility with unlimited transaction on any ATM and a higher accidental insurance cover of `2 Lakhs

netWoRk eXpanSion

• Operationalised 101 Banking Outlets (BO) including 24 in Unbanked Rural Centres (URCs) in FY 2019-20. During the year under review, we converted all our asset centres into banking outlets, complying with the requirements

of converting the erstwhile MFI branches to bank branches within three years from the commencement of banking operations

• As on March 31, 2020, we operated a network of 575 Banking Outlets, including 144 in Unbanked Rural Centres (URCs) locations, complying with the RBI prescribed norm of 25% of the BOs to be situated in URCs, and 475 ATMs including 52 Automated Cash Recyclers (ACR)

10 | AnnuAl RepoRt 2019-20