Page 259 - Demo

P. 259

Notes to financial statements

for the year ended March 31, 2020

FINANCIAL STATEMENTS

257

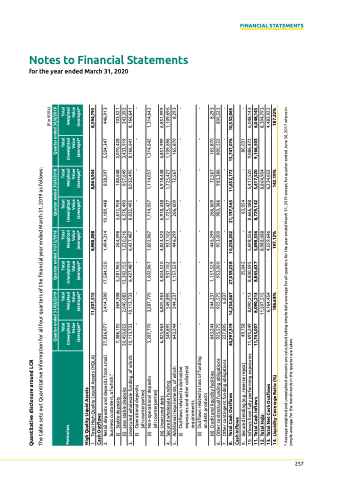

Quantitative disclosure around LcR

the table sets out Quantitative Information for all four quarters of the financial year ended March 31, 2019 as follows:

Total Particulars Unweighted

Total Weighted Value (average)*

Total Unweighted Value (average)*

Total Weighted Value (average)*

Total Unweighted Value (average)*

Total Weighted Value (average)*

Total Unweighted Value (average)*

Total Weighted Value (average)*

high quality Liquid Assets

1. total High Quality liquid Assets (HQlA)

11,507,515

8,988,088

8,864,904

8,394,793

Cash Outflows

2. Retail deposits and deposits from small business customers, of which:"

(i) Stable deposits

(ii) less stable deposits

27,836,977

2,414,390

17,584,120

1,494,314

10,189,448

838,297

5,504,347

446,913

3. unsecured wholesale funding, of which: (i) operational deposits

- 3,287,770

- 1,602,967

-

657,649 8,032,495 -

-

343,392 8,166,641 -

(all counterparties)

(ii) non-operational deposits

3,287,770

1,602,967

1,114,057

1,114,057

1,314,642

1,314,642

(all counterparties) (iii) unsecured debt

6,825,963 549,895 643,244

6,825,963 549,895 244,237

4,824,520 937,102 1,157,529 -

4,824,520 937,102 446,299

6,918,438 1,725,427 266,609 -

6,918,438 1,725,427 72,567 -

6,851,999 1,109,696 165,870 -

6,851,999 1,109,696 8,293 -

4. Secured wholesale funding

5. Additional requirements, of which

(i) outflows related to derivative

-

-

-

exposures and other collateral

requirements

(ii) outflows related to loss of funding

-

-

-

-

-

-

-

-

on debt products

(iii) Credit and liquidity facilities

643,244 925,575 227,895

244,237 925,575 6,837 14,254,667

1,157,529 953,000 - 27,059,238

446,299 953,000 - 10,258,202

266,609 983,386 - 21,197,365

72,567 983,386 - 11,652,172

165,870 800,522 - 15,747,076

8,293 800,522 - 10,532,065

6. other contractual funding obligations

7. other contingent funding obligations

8. Total Cash Outflows

Cash Inflows

40,297,319

9. Secured lending (e.g. reverse repos)

10. Inflows from fully performing exposures 11. Total Cash Inflows

12. Total hqla

13. Total Net Cash Outflows

14. Liquidity Coverage Ratio (%)

49,758 11,695,249 11,745,007

- 8,090,213 8,090,213 11,507,515 6,164,454 186.68%

35,042 8,830,595 8,865,637

- 5,698,556 5,698,556 8,988,088 4,559,646 197.12%

63,054 8,666,088 8,729,142

- 5,417,520 5,417,520 8,864,904 6,234,652 142.19%

80,031 9,086,472 9,166,503

- 6,048,143 6,048,143 8,394,793 4,483,922 187.22%

Quarter ended 31/03/2019

Quarter ended 31/12/2018

Quarter ended 30/9/2018

(` in 000's) Quarter ended 30/6/2018

Value (average)*

7,386,155 20,450,822 10,113,733

369,308 2,045,082 10,113,733 -

5,281,965 12,302,155 6,427,487 -

264,098 1,230,216 6,427,487

3,612,958 6,576,490 8,032,495

180,648

2,070,428 3,433,919 8,166,641

103,521

* Average weighted and unweighted amounts are calculated taking simple daily average for all quarters for the year ended March 31, 2019 except for quarter ended June 30, 2017 where in simple average for the month-ends in the quarter are taken.