Page 271 - Demo

P. 271

Notes to financial statements

for the year ended March 31, 2020

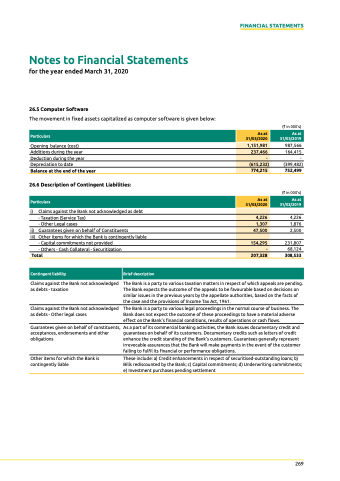

26.5 Computer software

the movement in fixed assets capitalized as computer software is given below:

opening balance (cost) Additions during the year Deduction during the year Depreciation to date

Balance at the end of the year

26.6 description of Contingent Liabilities:

i) Claims against the Bank not acknowledged as debt - taxation (Service tax)

- other legal cases

ii) Guarantees given on behalf of Constituents

iii) other items for which the Bank is contingently liable

FINANCIAL STATEMENTS

Particulars

As at 31/03/2020

1,151,981

As at 31/03/2019

237,466

-

(615,232)

774,215

Particulars

As at 31/03/2020

As at 31/03/2019

4,226

1,307

47,500

- Capital commitments not provided

- others - Cash Collateral - Securitization

Total

Claims against the Bank not acknowledged as debts - taxation

Claims against the Bank not acknowledged as debts - other legal cases

Guarantees given on behalf of constituents, acceptances, endorsements and other obligations

other items for which the Bank is contingently liable

(` in 000's)

987,566 164,415 -

(399,482)

752,499

(` in 000's)

4,226 1,876 2,500

231,807 68,124 308,533

the Bank is a party to various taxation matters in respect of which appeals are pending. the Bank expects the outcome of the appeals to be favourable based on decisions on similar issues in the previous years by the appellate authorities, based on the facts of the case and the provisions of Income tax Act, 1961.

the Bank is a party to various legal proceedings in the normal course of business. the Bank does not expect the outcome of these proceedings to have a material adverse effect on the Bank’s financial conditions, results of operations or cash flows.

As a part of its commercial banking activities, the Bank issues documentary credit and guarantees on behalf of its customers. Documentary credits such as letters of credit enhance the credit standing of the Bank’s customers. Guarantees generally represent irrevocable assurances that the Bank will make payments in the event of the customer failing to fulfil its financial or performance obligations.

these include: a) Credit enhancements in respect of securitised-outstanding loans; b) Bills rediscounted by the Bank; c) Capital commitments; d) underwriting commitments; e) Investment purchases pending settlement

154,295

-

207,328

Contingent liability

Brief description

269