Page 273 - Demo

P. 273

Notes to financial statements

for the year ended March 31, 2020

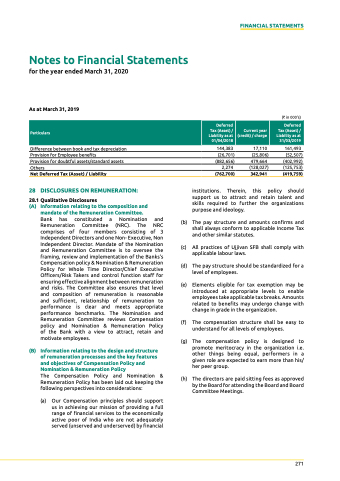

As at March 31, 2019

Difference between book and tax depreciation

provision for employee benefits

provision for doubtful assets/standard assets

others

Net deferred Tax (Asset) / Liability

28 dIsCLOsuRes ON ReMuNeRATION:

28.1 qualitative disclosures

(A) Information relating to the composition and mandate of the Remuneration committee.

Bank has constituted a nomination and Remuneration Committee (nRC). the nRC comprises of four members consisting of 3 Independent Directors and one non- executive, non Independent Director. Mandate of the nomination and Remuneration Committee is to oversee the framing, review and implementation of the Banks's Compensation policy & nomination & Remuneration policy for Whole time Director/Chief executive officers/Risk takers and control function staff for ensuring effective alignment between remuneration and risks. the Committee also ensures that level and composition of remuneration is reasonable and sufficient, relationship of remuneration to performance is clear and meets appropriate performance benchmarks. the nomination and Remuneration Committee reviews Compensation policy and nomination & Remuneration policy of the Bank with a view to attract, retain and motivate employees.

(b) Information relating to the design and structure of remuneration processes and the key features and objectives of compensation policy and nomination & Remuneration policy

the Compensation policy and nomination & Remuneration policy has been laid out keeping the following perspectives into considerations:

(a) our Compensation principles should support us in achieving our mission of providing a full range of financial services to the economically active poor of India who are not adequately served (unserved and underserved) by financial

144,383

(26,701)

(882,656)

2,274

(762,700)

17,110

(25,806)

479,664

(128,027)

342,941

(` in 000's)

161,493

(52,507)

(402,992)

(125,753)

(419,759)

FINANCIAL STATEMENTS

Particulars

Deferred Tax (Asset) / Liability as at 01/04/2018

Current year (credit) / charge

Deferred Tax (Asset) / Liability as at 31/03/2019

(b)

(c) (d) (e)

(f) (g)

(h)

institutions. therein, this policy should support us to attract and retain talent and skills required to further the organizations purpose and ideology.

the pay structure and amounts confirms and shall always conform to applicable Income tax and other similar statutes.

All practices of ujjivan SFB shall comply with applicable labour laws.

the pay structure should be standardized for a level of employees.

elements eligible for tax exemption may be introduced at appropriate levels to enable employees take applicable tax breaks. Amounts related to benefits may undergo change with change in grade in the organization.

the compensation structure shall be easy to understand for all levels of employees.

the compensation policy is designed to promote meritocracy in the organization i.e. other things being equal, performers in a given role are expected to earn more than his/ her peer group.

the directors are paid sitting fees as approved by the Board for attending the Board and Board Committee Meetings.

271