Page 198 - CAPE Financial Services Syllabus Macmillan_Neat

P. 198

-2-

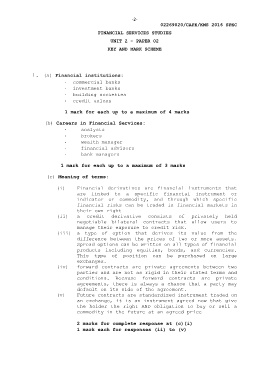

02269020/CAPE/KMS 2016 SPEC

FINANCIAL SERVICES STUDIES

UNIT 2 - PAPER 02

KEY AND MARK SCHEME

1. (a) Financial institutions:

- commercial banks

- investment banks

- building societies

- credit unions

1 mark for each up to a maximum of 4 marks

(b) Careers in Financial Services:

- analysts

- brokers

- wealth manager

- financial advisors

- bank managers

1 mark for each up to a maximum of 3 marks

(c) Meaning of terms:

(i) Financial derivatives are financial instruments that

(ii) are linked to a specific financial instrument or

(iii) indicator or commodity, and through which specific

financial risks can be traded in financial markets in

(iv) their own right

(v) a credit derivative consists of privately held

negotiable bilateral contracts that allow users to

manage their exposure to credit risk.

a type of option that derives its value from the

difference between the prices of two or more assets.

Spread options can be written on all types of financial

products including equities, bonds, and currencies.

This type of position can be purchased on large

exchanges.

forward contracts are private agreements between two

parties and are not as rigid in their stated terms and

conditions. Because forward contracts are private

agreements, there is always a chance that a party may

default on its side of the agreement.

Future contracts are standardized instrument traded on

an exchange, it is an instrument agreed now that give

the holder the right AND obligation to buy or sell a

commodity in the future at an agreed price

2 marks for complete response at (c)(i)

1 mark each for responses (ii) to (v)