Page 200 - CAPE Financial Services Syllabus Macmillan_Neat

P. 200

-4-

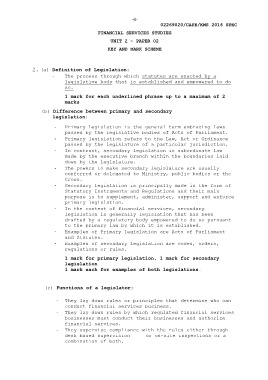

02269020/CAPE/KMS 2016 SPEC

FINANCIAL SERVICES STUDIES

UNIT 2 - PAPER 02

KEY AND MARK SCHEME

2. (a) Definition of Legislation:

- The process through which statutes are enacted by a

legislative body that is established and empowered to do

so.

1 mark for each underlined phrase up to a maximum of 2

marks

(b) Difference between primary and secondary

legislation:

- Primary Legislation is the general term embracing laws

passed by the legislative bodies of Acts of Parliament.

- Primary legislation refers to the Law, Act or Ordinance

passed by the legislature of a particular jurisdiction.

- In contrast, secondary legislation is subordinate law

made by the executive branch within the boundaries laid

down by the legislature.

- The powers to make secondary legislature are usually

conferred or delegated to Ministry, public bodies or the

Crown.

- Secondary legislation is principally made in the form of

Statutory Instruments and Regulations and their main

purpose is to supplement, administer, support and enforce

primary legislation.

- In the context of financial services, secondary

legislation is generally legislation that has been

drafted by a regulatory body empowered to do so pursuant

to the primary law by which it is established.

- Examples of Primary legislation are Acts of Parliament

and Statutes.

- Examples of secondary legislation are codes, orders,

regulations or rules.

1 mark for primary legislation, 1 mark for secondary

legislation

1 mark each for examples of both legislations.

(c) Functions of a legislator:

- They lay down rules or principles that determine who can

conduct financial services business.

- They lay down rules by which regulated financial services

businesses must conduct their businesses and authorize

financial services.

- They supervise compliance with the rules either through

desk based supervision or on-site inspections or a

combination of both.