Page 301 - Historical Summaries (Persian Gulf - Vol II) 1907-1953

P. 301

284

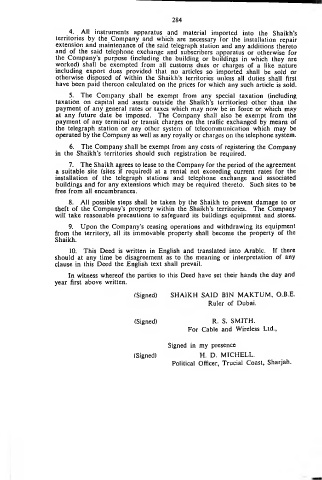

4. All instruments apparatus and material imported into the Shaikh’s

territories by the Company and which are necessary for the installation repair

extension and maintenance of the said telegraph station and any additions thereto

and of the said telephone exchange and subscribers apparatus or otherwise for

the Company’s purpose (including the building or buildings in which they are

worked) shall be exempted from all customs dues or charges of a like nature

including export dues provided that no articles so imported shall be sold or

otherwise disposed of within the Shaikh’s territories unless all duties shall first

have been paid thereon calculated on the prices for which any such article is sold.

5. The Company shall be exempt from any special taxation (including

taxation on capital and assets outside the Shaikh’s territories) other than the

payment of any general rates or taxes which may now be in force or which may

at any future date be imposed. The Company shall also be exempt from the

payment of any terminal or transit charges on the trallic exchanged by means of

the telegraph station or any other system of telecommunication which may be

operated by the Company as well as any royalty or charges on the telephone system.

6. The Company shall be exempt from any costs of registering the Company

in the Shaikh’s territories should such registration be required.

7. The Shaikh agrees to lease to the Company for the period of the agreement

a suitable site (sites if required) at a rental not exceeding current rates for the

installation of the telegraph stations and telephone exchange and associated

buildings and for any extensions which may be required thereto. Such sites to be

free from all encumbrances.

8. All possible steps shall be taken by the Shaikh to prevent damage to or

theft of the Company’s property within the Shaikh's territories. The Company

will take reasonable precautions to safeguard its buildings equipment and stores.

9. Upon the Company's ceasing operations and withdrawing its equipment

from the territory, all its immovable property shall become the property of the

Shaikh.

10. This Deed is written in English and translated into Arabic. If there

should at any time be disagreement as to the meaning or interpretation of any

clause in this Deed the English text shall prevail.

In witness whereof the parties to this Deed have set their hands the day and

year first above written.

(Signed) SHAIKH SAID BIN MAKTUM, O.B.E.

Ruler of Dubai.

(Signed) R. S. SMITH.

For Cable and Wireless Ltd.,

Signed in my presence

(Signed) H. D. MICHELL.

Political Officer, Trucial Coast, Sharjah.