Page 33 - Gulf Precis(VIII)_Neat

P. 33

part I-CHAPTER VII.

*7

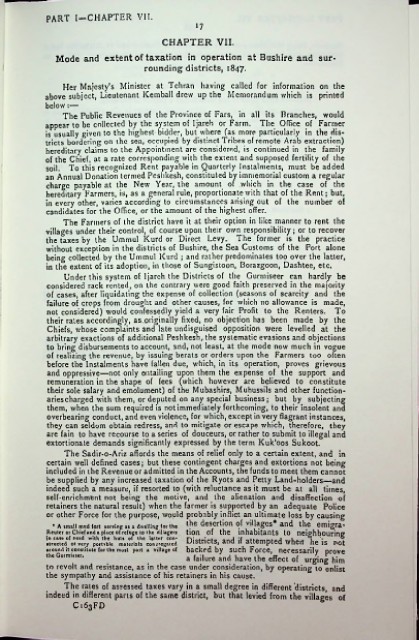

CHAPTER VII.

Mode and extent of taxation in operation at Bushire and sur

rounding districts, 1847.

Her Majesty’s Minister at Tehran having called for information on the

above subject, Lieutenant ICemball drew up the Memorandum which is printed

below:—

The Public Revenues of the Province of Fars, in all its Branches, would

appear to be collected by the system of Ijareh or Farm. The Oflice of Farmer

is usually given to the highest bidder, but where (as more particularly in the dis

tricts bordering on the sea, occupied by distinct Tribes of remote Arab extraction)

hereditary claims to the Appointment are considered, is continued in the family

of the Chief, at a rate corresponding with the extent and supposed fertility of the

soil. To this recognized Rent payable in Quarterly Instalments, must be added

an Annual Donation termed Peshkesh, constituted by immemorial custom a regular

charge payable at the New Year, the amount of which in the case of the

hereditary Farmers, is, as a general rule, proportionate with that of the Rent; but,

in every other, varies according to circumstances arising out of the number of

candidates for the Office, or the amount of the highest offer.

The Farmers of the district have it at their option in like manner to rent the

villages under their control, of course upon their own responsibility; or to recover

the taxes by the Ummul Kurd or Direct Levy. The former is the practice

without exception in the districts of Bushire, the Sea Customs of the Port alone

being collected by the Ummul Kurd ; and rather predominates too over the latter,

in the extent of its adoption, in those of Sungistoon, Borazgoon, Dashtee, etc.

Under this system of Ijareh the Districts of the Gurrniseer can hardly be

considered rack rented, on the contrary were good faith preserved in the majority

of cases, after liquidating the expense of collection (seasons of scarcity and the

failure of crops from drought and other causes, for which no allowance is made,

not considered) would confessedly yield a very fair Profit to the Renters. To

their rales accordingly, as originally fixed, no objection has been made by the

Chiefs, whose complaints and late undisguised opposition were levelled at the

arbitrary exactions of additional Peshkesh, the systematic evasions and objections

to bring disbursements to account, and, not least, at the mode now much in vogue

of realizing the revenue, by issuing berats or orders upon the Farmers too often

before the Instalments have fallen due, which, in its operation, proves grievous

and oppressive—not only entailing upon them the expense of the support and

remuneration in the shape of fees (which however are believed to constitute

their sole salary and emolument) of the Mubashirs, Muhussils and other function-

ariescharged with them, or deputed on any special business; but by subjecting

them, when the sum required is not immediately forthcoming, to their insolent and

overbearing conduct, and even violence, for which, except in very flagrant instances,

they can seldom obtain redress, and to mitigate or escape which, therefore, they

are fain to have recourse to a series of douceurs, or rather to submit to illegal and

extortionate demands significantly expressed by the term Kuk’oos Sukoot.

The Sadir-o-Ariz affords the means of relief only to a certain extent, and in

certain well defined cases; but these contingent charges and extortions not being

included in the Revenue or admitted in the Accounts, the funds to meet them cannot

be supplied by any increased taxation of the Ryots and Petty Land-holders—and

indeed such a measure, if resorted to (with reluctance as it must be at all times,

self-enrichment not being the motive, and the alienation and disaffection of

retainers the natural result) when the farmer is supported by an adequate Police

or other Force for the purpose, would probably inflict an ultimate loss by causing

• a small mud fo.i ...vio*>,, d»xiime to, th. the desertion of villages* and the emigra-

Reuter or Chief and a place of refuge to ihc villagers tlOn of the inhabitants tO neighbouring

in cast of need with ,k. h»,. ot the Utter con- Distr;ctSi and ;( attempted when Vis not

atructcd ol very portable materials congregated

around it constitute for the most part a village of backed by such Force, necessarily prove

the Guimisser. a failure and have the effect of urging him

to revolt and resistance, as in the case under consideration, by operating to enlist

the sympathy and assistance of his retainers in his cause.

The rates of assessed taxes vary in a small degree in different districts, and

indeed in different parts of the same district, but that levied from the villages of

C163FD