Page 50 - CSJ - ADF - AMB 10 07 19

P. 50

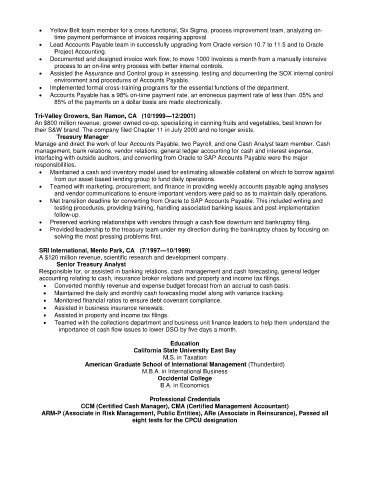

• Yellow Belt team member for a cross-functional, Six Sigma, process improvement team, analyzing on-

time payment performance of invoices requiring approval

• Lead Accounts Payable team in successfully upgrading from Oracle version 10.7 to 11.5 and to Oracle

Project Accounting.

• Documented and designed invoice work flow, to move 1000 invoices a month from a manually intensive

process to an on-line entry process with better internal controls.

• Assisted the Assurance and Control group in assessing, testing and documenting the SOX internal control

environment and procedures of Accounts Payable.

• Implemented formal cross-training programs for the essential functions of the department.

• Accounts Payable has a 98% on-time payment rate, an erroneous payment rate of less than .05% and

85% of the payments on a dollar basis are made electronically.

Tri-Valley Growers, San Ramon, CA (10/1999—12/2001)

An $800 million revenue, grower owned co-op, specializing in canning fruits and vegetables, best known for

their S&W brand. The company filed Chapter 11 in July 2000 and no longer exists.

Treasury Manager

Manage and direct the work of four Accounts Payable, two Payroll, and one Cash Analyst team member. Cash

management, bank relations, vendor relations, general ledger accounting for cash and interest expense,

interfacing with outside auditors, and converting from Oracle to SAP Accounts Payable were the major

responsibilities.

• Maintained a cash and inventory model used for estimating allowable collateral on which to borrow against

from our asset-based lending group to fund daily operations.

• Teamed with marketing, procurement, and finance in providing weekly accounts payable aging analyses

and vendor communications to ensure important vendors were paid so as to maintain daily operations.

• Met transition deadline for converting from Oracle to SAP Accounts Payable. This included writing and

testing procedures, providing training, handling associated banking issues and post-implementation

follow-up.

• Preserved working relationships with vendors through a cash flow downturn and bankruptcy filing.

• Provided leadership to the treasury team under my direction during the bankruptcy chaos by focusing on

solving the most pressing problems first.

SRI International, Menlo Park, CA (7/1997—10/1999)

A $120 million revenue, scientific research and development company.

Senior Treasury Analyst

Responsible for, or assisted in banking relations, cash management and cash forecasting, general ledger

accounting relating to cash, insurance broker relations and property and income tax filings.

• Converted monthly revenue and expense budget forecast from an accrual to cash basis.

• Maintained the daily and monthly cash forecasting model along with variance tracking.

• Monitored financial ratios to ensure debt covenant compliance.

• Assisted in business insurance renewals.

• Assisted in property and income tax filings.

• Teamed with the collections department and business unit finance leaders to help them understand the

importance of cash flow issues to lower DSO by five days a month.

Education

California State University East Bay

M.S. in Taxation

American Graduate School of International Management (Thunderbird)

M.B.A. in International Business

Occidental College

B.A. in Economics

Professional Credentials

CCM (Certified Cash Manager), CMA (Certified Management Accountant)

ARM-P (Associate in Risk Management, Public Entities), ARe (Associate in Reinsurance), Passed all

eight tests for the CPCU designation