Page 44 - 2019 Apple Supply Chain Co-op, Inc. Annual Report

P. 44

APPLE SUPPLY CHAIN CO-OP, INC.

NOTES TO FINANCIAL STATEMENTS

December 31, 2019 and 2018

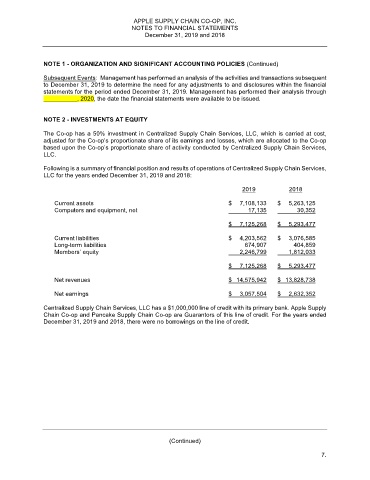

NOTE 1 - ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (Continued)

Subsequent Events: Management has performed an analysis of the activities and transactions subsequent

to December 31, 2019 to determine the need for any adjustments to and disclosures within the financial

statements for the period ended December 31, 2019. Management has performed their analysis through

__________, 2020, the date the financial statements were available to be issued.

NOTE 2 - INVESTMENTS AT EQUITY

The Co-op has a 50% investment in Centralized Supply Chain Services, LLC, which is carried at cost,

adjusted for the Co-op’s proportionate share of its earnings and losses, which are allocated to the Co-op

based upon the Co-op’s proportionate share of activity conducted by Centralized Supply Chain Services,

LLC.

Following is a summary of financial position and results of operations of Centralized Supply Chain Services,

LLC for the years ended December 31, 2019 and 2018:

2019 2018

Current assets $ 7,108,133 $ 5,263,125

Computers and equipment, net 17,135 30,352

$ 7,125,268 $ 5,293,477

Current liabilities $ 4,203,562 $ 3,076,585

Long-term liabilities 674,907 404,859

Members’ equity 2,246,799 1,812,033

$ 7,125,268 $ 5,293,477

Net revenues $ 14,575,942 $ 13,828,738

Net earnings $ 3,057,504 $ 2,632,352

Centralized Supply Chain Services, LLC has a $1,000,000 line of credit with its primary bank. Apple Supply

Chain Co-op and Pancake Supply Chain Co-op are Guarantors of this line of credit. For the years ended

December 31, 2019 and 2018, there were no borrowings on the line of credit.

(Continued)

7.