Page 6 - MarketCast 2021 EB Brochure - California

P. 6

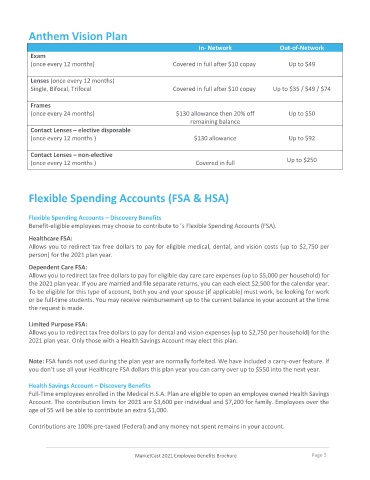

Anthem Vision Plan

In- Network Out-of-Network

Exam

(once every 12 months) Covered in full after $10 copay Up to $49

Lenses (once every 12 months)

Single, Bifocal, Trifocal Covered in full after $10 copay Up to $35 / $49 / $74

Frames

(once every 24 months) $130 allowance then 20% off Up to $50

remaining balance

Contact Lenses – elective disposable

(once every 12 months ) $130 allowance Up to $92

Contact Lenses – non-elective

(once every 12 months ) Covered in full Up to $250

Flexible Spending Accounts (FSA & HSA)

Flexible Spending Accounts – Discovery Benefits

Benefit-eligible employees may choose to contribute to ’s Flexible Spending Accounts (FSA).

Healthcare FSA:

Allows you to redirect tax free dollars to pay for eligible medical, dental, and vision costs (up to $2,750 per

person) for the 2021 plan year.

Dependent Care FSA:

Allows you to redirect tax free dollars to pay for eligible day care care expenses (up to $5,000 per household) for

the 2021 plan year. If you are married and file separate returns, you can each elect $2,500 for the calendar year.

To be eligible for this type of account, both you and your spouse (if applicable) must work, be looking for work

or be full-time students. You may receive reimbursement up to the current balance in your account at the time

the request is made.

Limited Purpose FSA:

Allows you to redirect tax free dollars to pay for dental and vision expenses (up to $2,750 per household) for the

2021 plan year. Only those with a Health Savings Account may elect this plan.

Note: FSA funds not used during the plan year are normally forfeited. We have included a carry-over feature. If

you don’t use all your Healthcare FSA dollars this plan year you can carry over up to $550 into the next year.

Health Savings Account – Discovery Benefits

Full-Time employees enrolled in the Medical H.S.A. Plan are eligible to open an employee owned Health Savings

Account. The contribution limits for 2021 are $3,600 per individual and $7,200 for family. Employees over the

age of 55 will be able to contribute an extra $1,000.

Contributions are 100% pre-taxed (Federal) and any money not spent remains in your account.

MarketCast 2021 Employee Benefits Brochure Page 5