Page 50 - Sector Alarm Annual Report 2020

P. 50

50/51

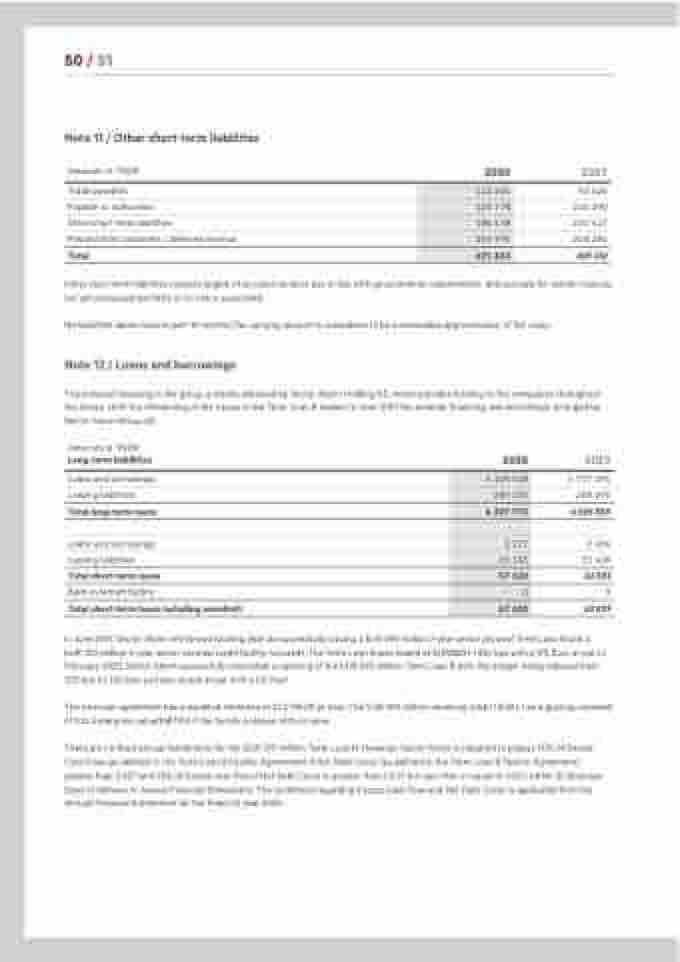

Note 11 / Other short-term liabilities

Amounts in TNOK

Trade payables

Payable to authorities

Other short-term liabilities

Prepaid from customers / deferred revenue

Total

2020

2019

92 426 110 290 150 413 248 284

601 412

111 401

123 778

186 478

249 996

671 653

Other short term liabilities consists largely of accrued vacation pay in line with governmental requirements and accruals for vendor invoices not yet processed and little or no risk is associated.

No liabilities above mature past 12 months.The carrying amount is considered to be a reasonable approximation of fair value.

Note 12 / Loans and borrowings

The external financing in the group is mainly obtained by Sector Alarm Holding AS, which provides funding to the companies throughout the Group. Until the refinancing of the Group in the Term Loan B market in June 2019 the external financing was accordingly arranged by Sector Alarm Group AS.

Amounts in TNOK

Long-term liabilities

Loans and borrowings Leasing liabilities Total long-term loans

Loans and borrowings

Leasing liabilities

Total short-term loans

Bank overdraft facility

Total short-term loans including overdraft

2020 2019

5 737 295 288 295 6 025 590

9 184 53 409 62 593 0 62 593

6 108 518

289 255

6 397 773

2 277

65 343

67 620

0

67 620

In June 2019, Sector Alarm refinanced existing debt by successfully issuing a EUR 590 million 7-year senior secured Term Loan B and a EUR 100 million 6-year senior secured credit facility (unused). The Term Loan B was issued at EURIBOR +350 bps with a 0% floor at par. In February 2020, Sector Alarm successfully concluded a repricing of the EUR 590 million Term Loan B with the margin being reduced from 350 bps to 300 bps and was issued at par with a 0% floor.

The new loan agreement has a dividend limitation of 22,5 MEUR pr year. The EUR 100 million revolving credit facility has a gearing covenant of 9,2x Enterprise value/EBITDA if the facility is drawn 40% or more .

There are no fixed annual instalments for the EUR 590 million Term Loan B. However, Sector Alarm is required to prepay 50% of Excess Cash Flow (as defined in the Term Loan B Facility Agreement) if Net Debt Cover (as defined in the Term Loan B Facility Agreement) greater than 5.00:1 and 25% of Excess cash flow if Net Debt Cover is greater than 4.50:1 but less than or equal to 5.00:1 within 20 Business Days of delivery of Annual Financial Statements. The conditions regarding Excess Cash Flow and Net Debt Cover is applicable from the Annual Financial Statements for the financial year 2020.