Page 48 - Sector Alarm Annual Report 2020

P. 48

48/49

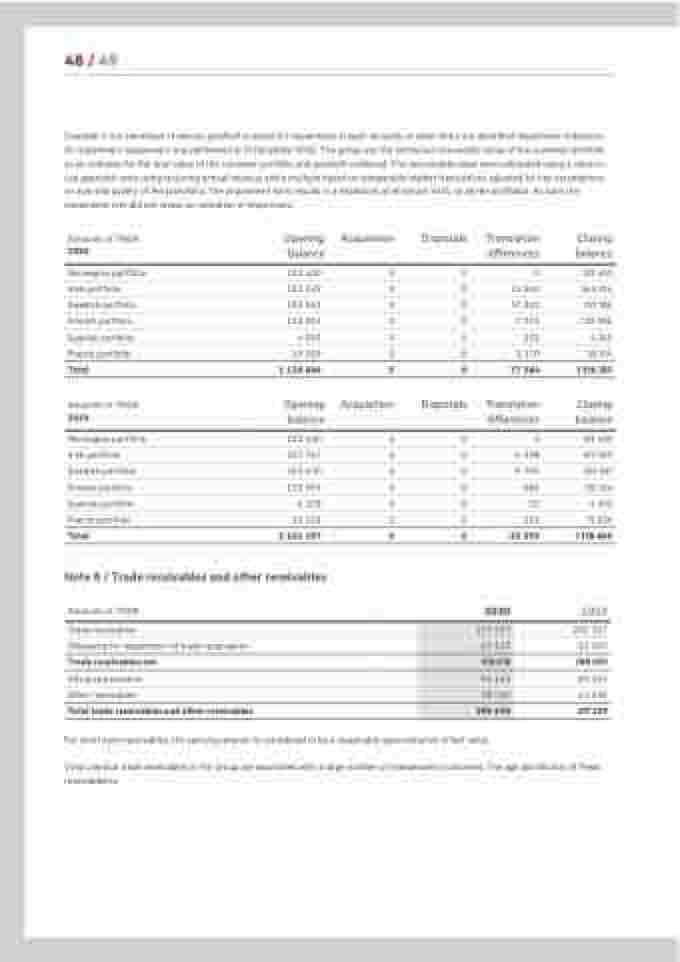

Goodwill is not amortised. However, goodwill is tested for impairment at least annually, or when there are identified impairment indicators. An impairment assessment was performed at 31 December 2020. The group use the estimated recoverable value of the customer portfolio as an indicator for the total value of the customer portfolio and goodwill combined. The recoverable value were calculated using a value in use approach were using recurring annual revenue and a multiple based on comparable market transactions adjusted for key assumptions on size and quality of the portofolio. The impairment tests results in a headroom of minimum 140% on all the portfolios. As such the impairment test did not reveal an indication of impairment.

Amounts in TNOK

2020

Norwegian portfolio

Irish portfolio

Swedish portfolio

Finnish portfolio

Spanish portfolio

French portfolio

Total

Amounts in TNOK

2019

Norwegian portfolio

Irish portfolio

Swedish portfolio

Finnish portfolio

Spanish portfolio

French portfolio

Total

Opening balance

133 420

513 349

353 961

115 014

4 093

19 029

1 138 866

Opening balance

133 420

517 747

363 670

115 999

4 128

19 192

1 154 157

Acquisition Disposals

0 0

0 0

0 0

0 0

0 0

0 0

0 0

Acquisition Disposals

0 0

0 0

0 0

0 0

0 0

0 0

0 0

Translation differences

0

31 565

37 225

7 072

252

1 170

77 284

Translation differences

0

-4 398

-9 709

-986

-35

-163

-15 291

2020

Closing balance

133 420

544 914

391 186 122 086 4 345

20 199

1 216 150

Closing balance

133 420

513 349

353 961 115 014 4 093

19 029

1 138 866

2019

202 167 -14 073 188 093

84 454 44 692 317 239

Note 8 / Trade receivables and other receivables Amounts in TNOK

Trade receivables

Allowance for impairment of trade receivables

Trade receivables net

Advance payments

Other receivables

Total trade receivables and other receivables

197 657

-19 139

178 518

94 162

18 015

290 695

For short-term receivables, the carrying amount is considered to be a reasonable approximation of fair value.

Total overdue trade receivables in the Group are associated with a large number of independent customers. The age distribution of these receivables is: