Page 49 - Sector Alarm Annual Report 2020

P. 49

Sector Alarm / Annual Report 2020

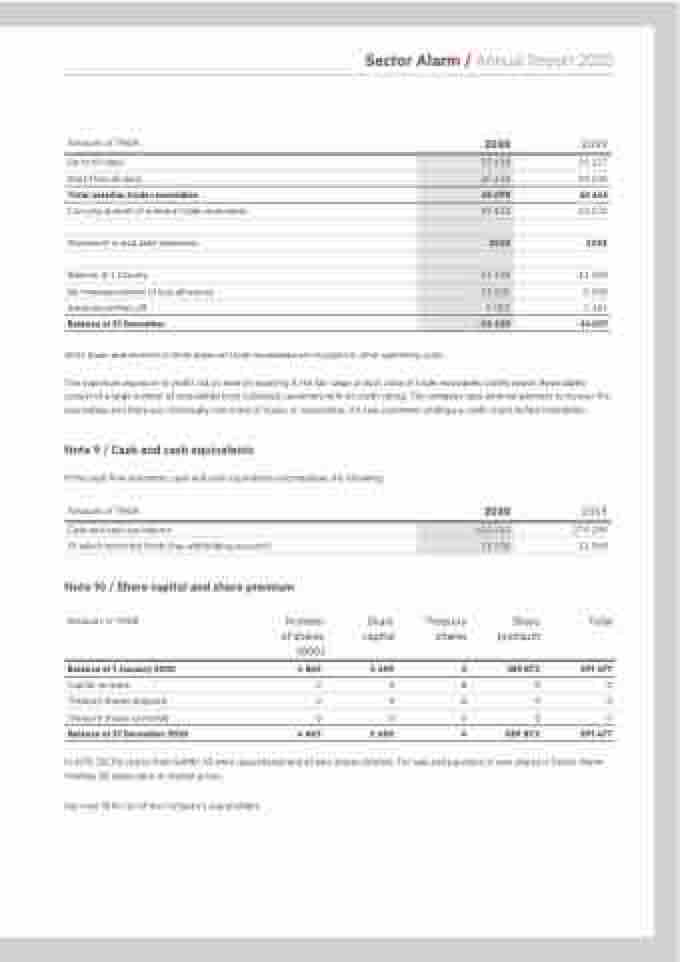

Amounts in TNOK

Up to 60 days

More than 60 days

Total overdue trade receivables

Carrying amount of overdue trade receivables

Movement in bad debt allowance:

Balance at 1 January

Net remeasurement of loss allowance

Amounts written off

Balance at 31 December

Write down and reversal of write down on trade receivables are included in other operating costs.

2020

2019

36 117 20 528 56 645 42 572

2019

-12 498 -5 030 3 454 -14 073

23 618

25 452

49 070

29 932

2020

-14 690

-13 501

9 052

-19 139

The maximum exposure to credit risk at time of reporting is the fair value of each class of trade receivables stated above. Receivables consist of a large number of receivables from individual customers with no credit rating. The company uses external partners to recover the receivables and there are, historically, low levels of losses on receivables. All new customers undergo a credit check before installation.

Note 9 / Cash and cash equivalents

In the cash flow statement, cash and cash equivalents encompasses the following:

Amounts in TNOK

Cash and cash equivalents

Of which restricted funds (tax withholding account):

Note 10 / Share capital and share premium

2020

Treasury Share shares premium

0 589 872

0 0

0 0

0 0

0 589 872

2019

270 298 11 068

Total

591 477

0

0

0

591 477

610 563

11 556

Amounts in TNOK

Balance at 1 January 2020

Capital increase

Treasury shares acquired

Treasury shares cancelled

Balance at 31 December 2020

Number of shares (000)

4 863

0

0

0

4 863

Share capital

1 605

0

0

0

1 605

In 2019, 126,312 shares from SAMIP AS were repurchased and all own shares deleted. The sale and purchase of own shares in Sector Alarm Holding AS takes place at market prices.

See note 18 for list of the Company’s shareholders.