Page 47 - Sector Alarm Annual Report 2020

P. 47

Sector Alarm / Annual Report 2020

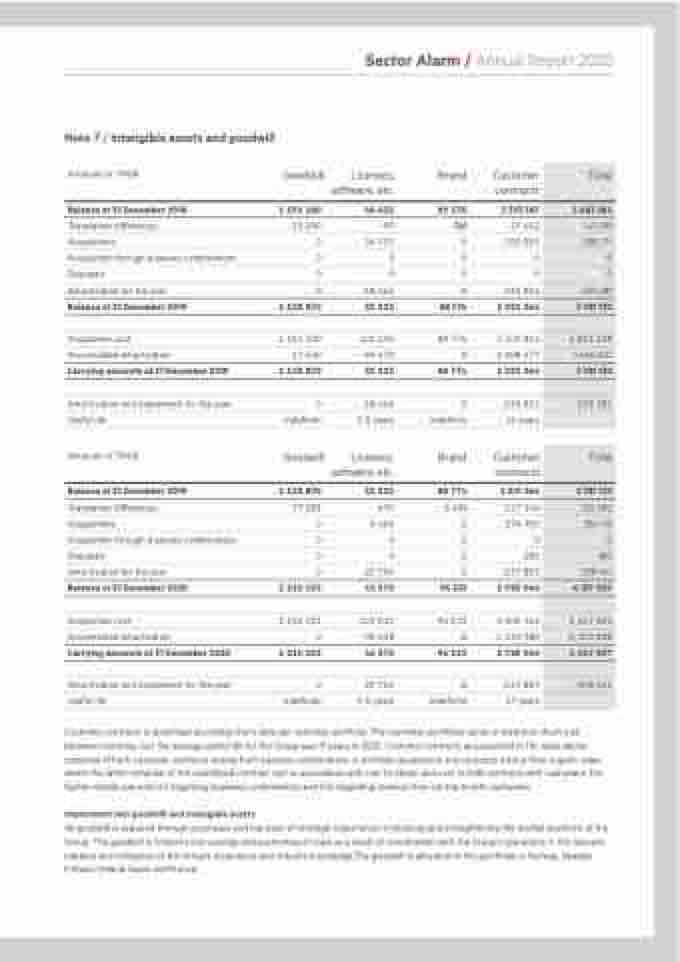

Note 7 / Intangible assets and goodwill Amounts in TNOK

Balance at 31 December 2018

Translation differences

Acquisitions

Acquisition through business combinations

Disposals

Amortization for the year

Balance at 31 December 2019

Acquisition cost Accumulated amortization

Carrying amounts at 31 December 2019

Amortization and impairment for the year

Useful life

Amounts in TNOK

Balance at 31 December 2019

Translation differences

Acquisitions

Acquisition through business combinations

Disposals

Amortization for the year

Balance at 31 December 2020

Acquisition cost Accumulated amortization

Carrying amounts at 31 December 2020

Amortization and impairment for the year

Useful life

Goodwill

1 154 160

-15 290

0

0

0

0

1 138 870

1 121 330

17 540

1 138 870

0

indefinite

Goodwill

1 138 870

77 282

0

0

0

0

1 216 153

1 216 153

0

1 216 153

0

Indefinite

Licenses, software, etc.

46 022

-90

24 757

0

0

-18 466

52 223

121 693

-69 470

52 223

-18 466

3-5 years

Licenses, software, etc.

52 223

699

9 406

0

0

-20 754

41 575

132 013

-90 438

41 575

-20 754

3-5 years

Brand

89 535

-761

0

0

0

0

88 774

88 774

0

88 774

0

indefinite

Brand

88 774

5 459

0

0

0

0

94233

94 233

0

94 233

0

Indefinite

Customer contracts

2 393 567

-27 442

355 955

0

0

-220 816

2 501 264

3 509 841

-1 008 577

2 501 264

-220 816

16 years

Customer contracts

2 501 264

147 140

374 709

0

-180

-237 887

2 785 046

4 005 426

-1 220 380

2 785 046

-237 887

17 years

Total

3 683 284

-43 583

380 711

0

0

-239 281

3 781 132

4 841 638

-1 060 507

3 781 132

-239 281

Total

3 781 132

230 580

384 115

0

-180

-258 641

4 137 007

5 447 824

-1 310 818

4 137 007

-258 641

Customer contracts is amortised according churn data per customer portfolio. The customer portfolios varies in historical churn and between countries, but the average useful life for the Group was 17 years in 2020. Customer contracts as presented in the table above comprise of both customer contracts arising from business combinations or portfolio acquisitons and contracts arising from organic sales, where the latter comprise of the capitalised contract cost in accordance with cost to obtain and cost to fulfil contracts with customers. For further details see note 2.5 regarding business combinations and 2.14 regarding revenue from contracts with customers.

Impairment test goodwill and intangible assets

All goodwill is acquired through purchases and has been of strategic importance in retaining and strengthening the market positions of the Group. The goodwill is linked to cost savings and economies of scale as a result of coordination with the Group’s operations in the relevant markets and utilization of the Group’s experience and industry knowledge.The goodwill is allocated to the portfolios in Norway, Sweden, Finland, Ireland, Spain and France.