Page 8 - NTDA Market Outlook Q1 2024

P. 8

www.ntda.org

8

U.S. Economic Snapshot

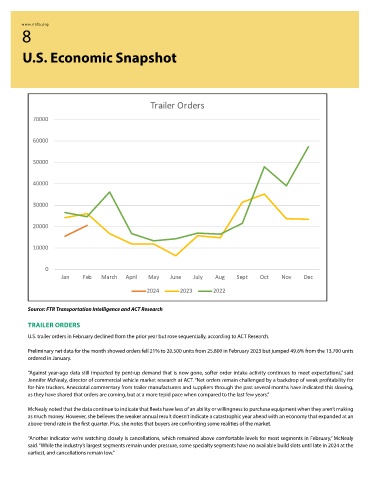

Trailer Orders

70000

60000

50000

40000

30000

20000

10000

0

Jan Feb March April May June July Aug Sept Oct Nov Dec

2024 2023 2022

Source: FTR Transportation Intelligence and ACT Research

TRAILER ORDERS

U.S. trailer orders in February declined from the prior year but rose sequentially, according to ACT Research.

Preliminary net data for the month showed orders fell 21% to 20,500 units from 25,800 in February 2023 but jumped 49.6% from the 13,700 units

ordered in January.

“Against year-ago data still impacted by pent-up demand that is now gone, softer order intake activity continues to meet expectations,” said

Jennifer McNealy, director of commercial vehicle market research at ACT. “Net orders remain challenged by a backdrop of weak profitability for

for-hire truckers. Anecdotal commentary from trailer manufacturers and suppliers through the past several months have indicated this slowing,

as they have shared that orders are coming, but at a more tepid pace when compared to the last few years.”

McNealy noted that the data continue to indicate that fleets have less of an ability or willingness to purchase equipment when they aren’t making

as much money. However, she believes the weaker annual result doesn’t indicate a catastrophic year ahead with an economy that expanded at an

above-trend rate in the first quarter. Plus, she notes that buyers are confronting some realities of the market.

“Another indicator we’re watching closely is cancellations, which remained above comfortable levels for most segments in February,” McNealy

said. “While the industry’s largest segments remain under pressure, some specialty segments have no available build slots until late in 2024 at the

earliest, and cancellations remain low.”