Page 3 - Market Outlook Q3 2025

P. 3

Q3, 2025

3

North American Trailer

Economic Overview

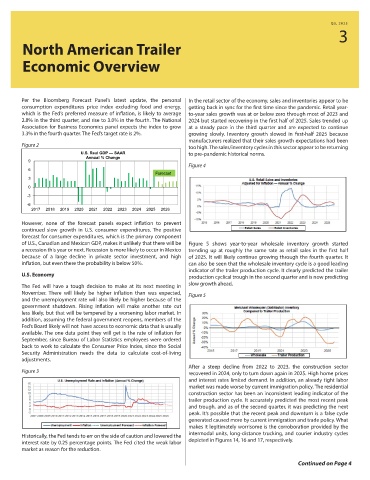

Per the Bloomberg Forecast Panel’s latest update, the personal In the retail sector of the economy, sales and inventories appear to be

consumption expenditures price index excluding food and energy, getting back in sync for the first time since the pandemic. Retail year-

which is the Fed’s preferred measure of inflation, is likely to average to-year sales growth was at or below zero through most of 2023 and

2.8% in the third quarter, and rise to 3.0% in the fourth. The National 2024 but started recovering in the first half of 2025. Sales trended up

Association for Business Economics panel expects the index to grow at a steady pace in the third quarter and are expected to continue

3.3% in the fourth quarter. The Fed’s target rate is 2%. growing slowly. Inventory growth slowed in first-half 2025 because

manufacturers realized that their sales growth expectations had been

Figure 2 too high. The sales/inventory cycles in this sector appear to be returning

U.S. Real GDP — SAAR to pre-pandemic historical norms.

Annual % Change

9

Figure 4

6

Forecast

3

0

-3

-6

2017 2018 2019 2020 2021 2022 2023 2024 2025 2026

However, none of the forecast panels expect inflation to prevent

continued slow growth in U.S. consumer expenditures. The positive

forecast for consumer expenditures, which is the primary component

of U.S., Canadian and Mexican GDP, makes it unlikely that there will be Figure 5 shows year-to-year wholesale inventory growth started

a recession this year or next. Recession is more likely to occur in Mexico trending up at roughly the same rate as retail sales in the first half

because of a large decline in private sector investment, and high of 2025. It will likely continue growing through the fourth quarter. It

inflation, but even there the probability is below 50%. can also be seen that the wholesale inventory cycle is a good leading

indicator of the trailer production cycle. It clearly predicted the trailer

U.S. Economy production cyclical trough in the second quarter and is now predicting

slow growth ahead.

The Fed will have a tough decision to make at its next meeting in

November. There will likely be higher inflation than was expected, Figure 5

and the unemployment rate will also likely be higher because of the

government shutdown. Rising inflation will make another rate cut

less likely, but that will be tempered by a worsening labor market. In

addition, assuming the federal government reopens, members of the

Fed’s Board likely will not have access to economic data that is usually

available. The one data point they will get is the rate of inflation for

September, since Bureau of Labor Statistics employees were ordered

back to work to calculate the Consumer Price Index, since the Social

Security Administration needs the data to calculate cost-of-living

adjustments.

After a steep decline from 2022 to 2023, the construction sector

Figure 3 recovered in 2024, only to turn down again in 2025. High home prices

and interest rates limited demand. In addition, an already tight labor

market was made worse by current immigration policy. The residential

construction sector has been an inconsistent leading indicator of the

trailer production cycle. It accurately predicted the most recent peak

and trough, and as of the second quarter, it was predicting the next

peak. It’s possible that the recent peak and downturn is a false cycle

generated caused more by current immigration and trade policy. What

makes it legitimately worrisome is the corroboration provided by the

intermodal units, long-distance trucking, and courier industry cycles

Historically, the Fed tends to err on the side of caution and lowered the

interest rate by 0.25 percentage points. The Fed cited the weak labor depicted in Figures 14, 16 and 17, respectively.

market as reason for the reduction.

Continued on Page 4