Page 6 - Market Outlook Q3 2025

P. 6

www.ntda.org

6

North American Trailer

Economic Overview

Figure 6 once again became an issue, because of tariffs. We are watching history

repeat itself as of September this year. The Fed lowered its benchmark

rate at its September meeting, but as was the case last year, inflation is

rising again. Last year, inflation stopped trending down because of a

surge in consumer demand due to the expectation that tariffs would

cause price increases. This year, inflation has been trending up because

last year’s expectations were correct.

Figure 9

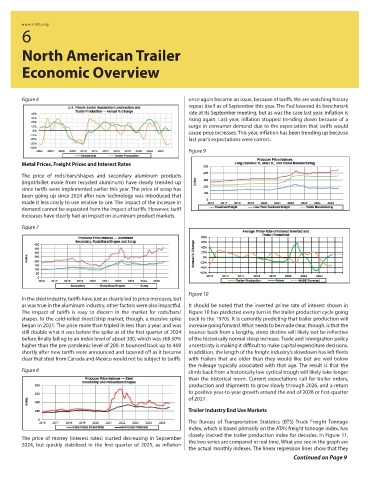

Metal Prices, Freight Prices and Interest Rates

The price of rods/bars/shapes and secondary aluminum products

(ingot/billet made from recycled aluminum) have clearly trended up

since tariffs were implemented earlier this year. The price of scrap has

been going up since 2024 after new technology was introduced that

made it less costly to use relative to ore. The impact of the increase in

demand cannot be separated from the impact of tariffs. However, tariff

increases have clearly had an impact on aluminum product markets.

Figure 7

Figure 10

In the steel industry, tariffs have just as clearly led to price increases, but

as was true in the aluminum industry, other factors were also impactful. It should be noted that the inverted prime rate of interest shown in

The impact of tariffs is easy to discern in the market for rods/bars/ Figure 10 has predicted every turn in the trailer production cycle going

shapes. In the cold-rolled sheet/strip market, though, a massive spike back to the 1970s. It is currently predicting that trailer production will

began in 2021. The price more than tripled in less than a year and was increase going forward. What needs to be made clear, though, is that the

still double what it was before the spike as of the first quarter of 2024 bounce back from a lengthy, steep decline will likely not be reflective

before finally falling to an index level of about 300, which was still 50% of the historically normal steep increase. Trade and immigration policy

higher than the pre-pandemic level of 200. It bounced back up to 400 uncertainty is making it difficult to make capital expenditure decisions.

shortly after new tariffs were announced and tapered off as it became In addition, the length of the freight industry’s slowdown has left fleets

clear that steel from Canada and Mexico would not be subject to tariffs. with trailers that are older than they would like but are well below

the mileage typically associated with that age. The result is that the

Figure 8 climb back from a historically low cyclical trough will likely take longer

than the historical norm. Current expectations call for trailer orders,

The prices of truckload and less-than-truckload freight are both highly

correlated with the price of trailers, as can be seen in Figure 9. Less-than- production and shipments to grow slowly through 2026, and a return

truckload pricing responded quickly to new tariff announcements. It to positive year-to-year growth around the end of 2026 or first-quarter

took a while, but truckload freight and trailer prices are also going up at of 2027.

this point. As has been the case historically, it will probably take a few Trailer Industry End Use Markets

months for long-run stable prices to be reached.

The Bureau of Transportation Statistics (BTS) Truck Freight Tonnage

Insert figure 9 Index, which is based primarily on the ATA’s freight tonnage index, has

closely tracked the trailer production index for decades. In Figure 11,

The price of money (interest rates) started decreasing in September

2024, but quickly stabilized in the first quarter of 2025, as inflation the two series are compared in real time. What you see in the graph are

the actual monthly indexes. The linear regression lines show that they

Continued on Page 9