Page 4 - MIADA-Q4-2021

P. 4

Fraud Against Car Dealers Has

Never Been More Prevalent

By Frank McKenna, Co-founder and Chief Fraud Strategist for Point Predictive

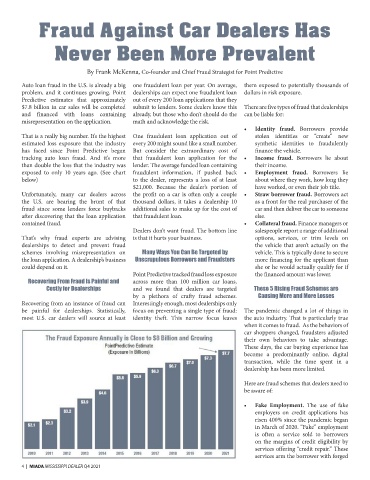

Auto loan fraud in the U.S. is already a big one fraudulent loan per year. On average, them exposed to potentially thousands of

problem, and it continues growing. Point dealerships can expect one fraudulent loan dollars in risk exposure.

Predictive estimates that approximately out of every 200 loan applications that they

$7.8 billion in car sales will be completed submit to lenders. Some dealers know this There are five types of fraud that dealerships

and financed with loans containing already, but those who don’t should do the can be liable for:

misrepresentation on the application. math and acknowledge the risk.

• Identity fraud. Borrowers provide

That is a really big number. It’s the highest One fraudulent loan application out of stolen identities or “create” new

estimated loss exposure that the industry every 200 might sound like a small number. synthetic identities to fraudulently

has faced since Point Predictive began But consider the extraordinary cost of finance the vehicle.

tracking auto loan fraud. And it’s more that fraudulent loan application for the • Income fraud. Borrowers lie about

than double the loss that the industry was lender. The average funded loan containing their income.

exposed to only 10 years ago. (See chart fraudulent information, if pushed back • Employment fraud. Borrowers lie

below) to the dealer, represents a loss of at least about where they work, how long they

$21,000. Because the dealer’s portion of have worked, or even their job title.

Unfortunately, many car dealers across the profit on a car is often only a couple • Straw borrower fraud. Borrowers act

the U.S. are bearing the brunt of that thousand dollars, it takes a dealership 10 as a front for the real purchaser of the

fraud since some lenders force buybacks additional sales to make up for the cost of car and then deliver the car to someone

after discovering that the loan application that fraudulent loan. else.

contained fraud. • Collateral fraud. Finance managers or

Dealers don’t want fraud. The bottom line salespeople report a range of additional

That’s why fraud experts are advising is that it hurts your business. options, services, or trim levels on

dealerships to detect and prevent fraud the vehicle that aren’t actually on the

schemes involving misrepresentation on Many Ways You Can Be Targeted by vehicle. This is typically done to secure

the loan application. A dealership’s business Unscrupulous Borrowers and Fraudsters more financing for the applicant than

could depend on it. she or he would actually qualify for if

Point Predictive tracked fraud loss exposure the financed amount was lower.

Recovering From Fraud Is Painful and across more than 100 million car loans,

Costly for Dealerships and we found that dealers are targeted These 5 Rising Fraud Schemes are

by a plethora of crafty fraud schemes. Causing More and More Losses

Recovering from an instance of fraud can Interestingly enough, most dealerships only

be painful for dealerships. Statistically, focus on preventing a single type of fraud: The pandemic changed a lot of things in

most U.S. car dealers will source at least identity theft. This narrow focus leaves the auto industry. That is particularly true

when it comes to fraud. As the behaviors of

car shoppers changed, fraudsters adjusted

their own behaviors to take advantage.

These days, the car buying experience has

become a predominantly online, digital

transaction, while the time spent in a

dealership has been more limited.

Here are fraud schemes that dealers need to

be aware of:

• Fake Employment. The use of fake

employers on credit applications has

risen 400% since the pandemic began

in March of 2020. “Fake” employment

is often a service sold to borrowers

on the margins of credit eligibility by

services offering “credit repair.” These

services arm the borrower with forged

4 | MIADA MISSISSIPPI DEALER Q4 2021