Page 5 - AfrOil Week 35

P. 5

AfrOil COMMENTARY AfrOil

It provides for opening 45 onshore and offshore Brazilian oil output to top the 3mn bpd mark for

blocks up for exploration by the middle of the the first time ever last year.

decade. Angolan authorities aim to sign explo-

ration contracts for the first 33 of these blocks – Ultra-deepwater hazards

which lie offshore in the Lower Congo, Kwanza Yet Angola will need more than potential to

and Benguela basins – by 2023. They hope to see succeed – as Brazil saw during its last offshore

another 12 contracts finalised by 2025. licensing round. It will also need favourable eco-

Part of this process will involve defining the nomic and market conditions.

boundaries of the blocks that will be offered up There are a number of problems associated

to investors. Luanda intends to fix those outlines with exploration and production in ultra-deep-

for onshore exploration areas between 2020 and water areas, and one of the most important of

2022 and do the same for the ultra-deepwater these is the high price tag. Brazil’s pre-salt fields

section of the Kwanza and Benguela basins have not been cheap to develop. Although pro-

between 2022 and 2024. duction costs have sunk in recent years, break-

The total cost of this exploration programme even prices are still high – in the range of $35-45 “

is expected to approach $870mn. According to per barrel, according to Petrobras. Angola needs

Angola’s state press agency, the government will This is hardly surprising, given the Brazil-

cover about $188mn of this sum, and another ian pre-salt zone’s remote location. The fields favourable

$679mn will come from outside investors, in question lie hundreds of km from shore, so

including participants in joint and multi-client they do not always have connections or access economic

study programmes. to existing infrastructure such as pipelines and

processing plants. Additionally, their developers and market

Pre-salt analogue must spend no small amount of money to move conditions, as

Luanda hopes that this five-year campaign will all of the workers, equipment, parts, supplies

yield sufficient data to lead to the discovery of and support vessels they need for exploration well as potential,

enough oil to keep the country’s production lev- and development projects out from shore to the

els at 1mn bpd for the next 20 years. To this end, drilling sites. to succeed

it is targeting parts of the offshore zone that it There is no reason to believe that the areas

hopes will prove similar to the pre-salt zone off Angola is targeting will be any different. The

the coast of Brazil. ultra-deepwater sites targeted in the Kwanza and

Both of these areas lie in deepwater sec- Benguela basins are far from shore, just like the

tions of the South Atlantic Ocean. They are Brazilian pre-salt fields, so explorers and devel-

quite distant from each other now, but they are opers will have to bear the expense of moving

believed to have been adjacent up until around people, equipment and goods out to sea. They

140mn years ago, when the western section of are also lacking in infrastructure, just as the

the Gondwana supercontinent split up to form Brazilian pre-salt zone did at first, so explorers

Africa and South America. More specifically, and developers may have to bear the additional

GeoExpro noted in 2015, the Kwanza and Ben- expenses associated with offshore construction.

guela basins offshore Angola appear to be pre- In other words, Angola has little reason to

salt analogues of the Santos and Campos basins expect that its ultra-deepwater costs will be any

offshore Brazil. lower than those prevailing offshore Brazil.

This is intriguing for upstream operators, If so, this is a worrying prospect. Brent crude

given that the Brazilian pre-salt zone is highly is currently trading in the mid-$40s, near the

prospective. Petrobras, the national oil com- high end of Petrobras’ estimated break-even

pany (NOC) of Brazil, has estimated the region’s range. Industry analysts do believe prices will

reserves at more than 15bn barrels. It has also rise before the end of 2020, but markets may

made a number of major discoveries, both remain weak – especially if the pandemic per-

independently and working with foreign part- sists and global energy demand remains slug-

ners, at ultra-deepwater fields such as Lula and gish. In turn, this weakness could greatly slow

Búzios. Additionally, it has succeeded in bring- the push toward offshore exploration and devel-

ing enough of these new sites on stream for opment.

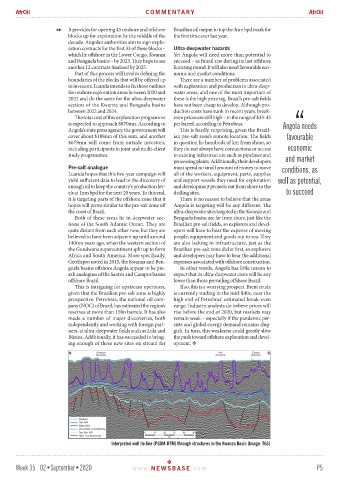

Interpreted well tie line (PSDM-RTM) through structures in the Kwanza Basin (Image: TGS)

Interpreted well tie line (PSDM-RTM) through structures in the Kwanza Basin (Image: TGS)

Week 35 02•September•2020 www. NEWSBASE .com P5