Page 5 - MEOG Week 26 2022

P. 5

MEOG COMMENTARY MEOG

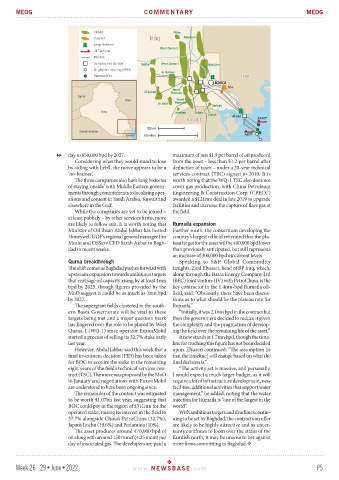

day to 850,000 bpd by 2027. maximum of just $1.9 per barrel of oil produced

Considering what they would stand to lose from the asset – less than $1.2 per barrel after

by siding with Erbil, the move appears to be a deduction of taxes – under a 20-year technical

‘no-brainer’. services contract (TSC) signed in 2010. It is

The three companies also have long histories worth noting that the WQ-1 TSC also does not

of staying ‘onside’ with Middle Eastern govern- cover gas production, with China Petroleum

ments through commitments to localising oper- Engineering & Construction Corp. (CPECC)

ations and content in Saudi Arabia, Kuwait and awarded a $121mn deal in late 2019 to upgrade

elsewhere in the Gulf. facilities and increase the capture of flare gas at

While the companies are yet to be joined – the field.

at least publicly – by other services firms, more

are likely to follow suit. It is worth noting that Rumaila expansion

Minister of Oil Ihsan Abdul Jabbar has hosted Further south, the consortium developing the

Honeywell UOP’s regional general manager Jim country’s largest oilfield reiterated that the pla-

Moshi and OilServ CEO Sarah Akbar in Bagh- teau target for the asset will be 400,000 bpd lower

dad in recent weeks. than previously anticipated, but still represents

an increase of 300,000 bpd on current levels.

Qurna breakthrough Speaking to S&P Global Commodity

The shift comes as Baghdad pushes forward with Insights, Zaid Elyaseri, head of BP Iraq, which,

upstream expansion towards ambitious targets along through the Basra Energy Company Ltd

that envisage oil capacity rising by at least 1mn (BEC) joint venture (JV) with PetroChina, is the

bpd by 2025, though figures provided by the key contractor in the 1.4mn-bpd Rumaila oil-

MoO suggest it could be as much as 3mn bpd field, said: “Obviously, there have been discus-

by 2027. sions as to what should be the plateau rate for

The supergiant fields clustered in the south- Rumaila.”

ern Basra Governorate will be vital to these “Initially, it was 2.1mn bpd in the contract but

targets being met and a major question mark then the government decided to reduce it given

has lingered over the role to be played by West the complexity and the pragmatism of develop-

Qurna-1 (WQ-1) since operator ExxonMobil ing the field over the remaining life of the asset.”

started a process of selling its 32.7% stake early It now stands at 1.7mn bpd, though the time-

last year. line for reaching this figure has not been decided

However, Abdul Jabbar said this week that a upon. Elyaseri continued: “The assumption [is

final investment decision (FID) has been taken that the timeline] will change based on what the

for BOC to acquire the stake in the remaining final decision is.”

eight years of the field’s technical services con- “The activity set is massive, and personally,

tract (TSC). The move was proposed by the MoO I would expect a much larger budget, as it will

in January and negotiations with ExxonMobil require a lot of infrastructure development, new

are understood to have been ongoing since. facilities, additional activities that support water

The remainder of the contract was estimated management,” he added, noting that the water

to be worth $1.07bn last year, suggesting that injection for Rumaila is “one of the largest in the

BOC could pay in the region of $311mn for the world”.

operated stake, raising its interest in the field to With ambitious targets and deadlines contin-

37.7% alongside China’s PetroChina (32.7%), uing to be set by Baghdad, the contracts on offer

Japan’s Itochu (19.6%) and Pertamina (10%). are likely to be highly attractive and as uncer-

The asset produces around 470,000 bpd of tainty continues to loom over the status of the

oil along with around 150 mmcf (4.25 mcm) per Kurdish north, it may be unwise to bet against

day of associated gas. The developers are paid a more firms committing to Baghdad.

Week 26 29•June•2022 www. NEWSBASE .com P5