Page 9 - EurOil Week 25 2022

P. 9

EurOil PIPELINES & TRANSPORT EurOil

space to weaponise gas exports. He is swimming be turning the screws on Europe if we had sanc-

in cash. So why not turn the screws,” said Robin tions on maritime insurance, stopping oil tank-

Brookes, chief economist at Institute of Interna- ers taking oil out of Russia? No! He’d be battling

tional Finance (IIF), in a tweet. a currency crisis the way Ukraine currently is,

“Ironically, the EU – by permitting the mas- having to hike interest rates and scrounging for

sive rise in Greek tankers taking oil out of Rus- every unit of hard currency… By allowing Putin

sian ports (blue) – is the biggest enabler of this to export his oil globally, we’re giving him the

weaponisation of gas exports, by giving Putin means to cut gas exports to Europe. Sanctions on

the shipping capacity to take his oil to places all maritime insurance fix this, but the West must

around the world,” Brookes added. “Would Putin be willing to suffer high oil prices temporarily.”

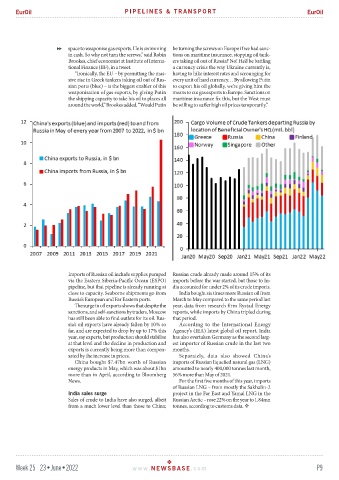

Imports of Russian oil include supplies pumped Russian crude already made around 15% of its

via the Eastern Siberia-Pacific Ocean (ESPO) imports before the war started, but those to In-

pipeline, but that pipeline is already running at dia accounted for under 2% of its crude imports.

close to capacity. Seaborne shipments go from India bought six times more Russian oil from

Russia’s European and Far Eastern ports. March to May compared to the same period last

The surge in oil exports shows that despite the year, data from research firm Rystad Energy

sanctions, and self-sanctions by traders, Moscow reports, while imports by China tripled during

has still been able to find outlets for its oil. Rus- that period.

sia’s oil exports have already fallen by 10% so According to the International Energy

far, and are expected to drop by up to 17% this Agency’s (IEA) latest global oil report, India

year, say experts, but production should stabilise has also overtaken Germany as the second larg-

at that level and the decline in production and est importer of Russian crude in the last two

exports is currently being more than compen- months.

sated by the increase in prices. Separately, data also showed China’s

China bought $7.47bn worth of Russian imports of Russian liquefied natural gas (LNG)

energy products in May, which was about $1bn amounted to nearly 400,000 tonnes last month,

more than in April, according to Bloomberg 56% more than May of 2021.

News. For the first five months of this year, imports

of Russian LNG – from mostly the Sakhalin-2

India sales surge project in the Far East and Yamal LNG in the

Sales of crude to India have also surged, albeit Russian Arctic – rose 22% on the year to 1.84mn

from a much lower level than those to China; tonnes, according to customs data.

Week 25 23•June•2022 www. NEWSBASE .com P9