Page 9 - LatAmOil Week 44 2022

P. 9

LatAmOil VENEZUEL A LatAmOil

TotalEnergies, for example, took a $1.38bn Days ago, an official passed by and said the com-

knock in the process of transferring its 30% pany had not respected its contract,” one worker

stake in Petrocedeno to a PdVSA unit. While from Petrozamora complained, according to a

this exit did free the French company from past report from Reuters.

and future liabilities, it also prevented the com- The worker was making a report to Neth-

pany from receiving the dividends and debts erlands-based GBP Global Resources’ move to

that had been owed to it up to that point. abandon its minority stake in a joint venture

Meanwhile, these withdrawals have also had with PdVSA in September of this year, the news

a negative impact on workers, many of whom agency said.

have lost their jobs when IOCs have departed Following the mass departures, the size of

from the struggling South American country. PdVSA’s workforce has declined from 110,000

“They left without paying us completely. staff members to 60,000.

GUYANA

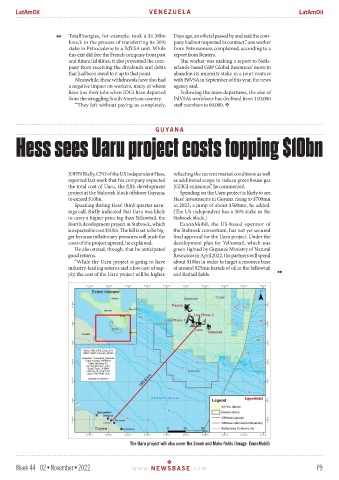

Hess sees Uaru project costs topping $10bn

JOHN Rielly, CFO of the US independent Hess, reflecting the current market conditions as well

reported last week that his company expected as additional scope to reduce greenhouse gas

the total cost of Uaru, the fifth development [GHG] emissions,” he commented.

project at the Stabroek block offshore Guyana, Spending on the Uaru project is likely to see

to exceed $10bn. Hess’ investments in Guyana rising to $700mn

Speaking during Hess’ third-quarter earn- in 2023, a jump of about $500mn, he added.

ings call, Rielly indicated that Uaru was likely (The US independent has a 30% stake in the

to carry a higher price tag than Yellowtail, the Stabroek block.)

fourth development project at Stabroek, which ExxonMobil, the US-based operator of

is expected to cost $10bn. The bill is set to be big- the Stabroek consortium, has not yet secured

ger because inflationary pressures will push the final approval for the Uaru project. Under the

costs of the project upward, he explained. development plan for Yellowtail, which was

He also stated, though, that he anticipated green-lighted by Guyana’s Ministry of Natural

good returns. Resources in April 2022, the partners will spend

“While the Uaru project is going to have about $10bn in order to target a resource base

industry-leading returns and a low cost of sup- of around 925mn barrels of oil in the Yellowtail

ply, the cost of the Uaru project will be higher, and Redtail fields.

The Uaru project will also cover the Snoek and Mako fields (Image: ExxonMobil)

Week 44 02•November•2022 www. NEWSBASE .com P9