Page 4 - DMEA Week 29 2022

P. 4

DMEA COMMENTARY DMEA

Middle East cargoes

easing Europe’s strain

Crude and product shipments from the Middle East are easing

the strain on European refiners as Russian volumes head East.

MIDDLE EAST AS the European Union closes in on a formal Alexandria – so far in July, nearly double the level

embargo on purchases of Russian oil, concerns of the same month last year.

have turned to identifying possible replacements Saudi Arabia accounts for the bulk of the

WHAT: for these cargoes. piped volumes, with Iraq also increasing

Oil flows to Europe from With the Middle East being home to the supplies.

the Middle East have shot majority of the world’s proven oil reserves, the Meanwhile the latter has also been raising

up as Russian volumes region’s top producers have been called on to the number of cargoes it sends towards Europe

head to Asia. raise upstream output. through the Suez Canal.

While these calls have largely fallen on deaf The pipeline’s total daily average has risen to

WHY: ears, Saudi Arabia and Iraq have diverted exist- 1.09mn bpd, all of which is destined for Europe,

Self-imposed restrictions ing production towards Europe, expanding the highest volume since April 2020. Middle

on the purchase of inter-regional trade as Russian crude is snapped Eastern countries – mainly Iraq – have also been

Russian oil are shifting up by China and India at discounted rates on sending around 1.2mn bpd of cargoes to Europe

trade dynamics. account of the former’s limited market. through Suez, giving a rough total of 2.2mn

Further downstream, a new refinery in bpd of crude trade. This would represent a 90%

WHAT NEXT: Kuwait is set to begin marketing new supplies increase compared to January, before the conflict

Refined product of low and very low sulphur fuel oil (LSFO and in Ukraine began.

shipments are likely VLSFO) ahead of next year’s ban on buying Rus- Meanwhile, Russian crude is going in the

to grow in the months sian refined products. opposite direction via ports in the Baltic and the

ahead as the EU moves to Black Sea, supplying China and India at heavily

restrict Russian supplies SuMed supplies discounted prices, in a major, though likely tem-

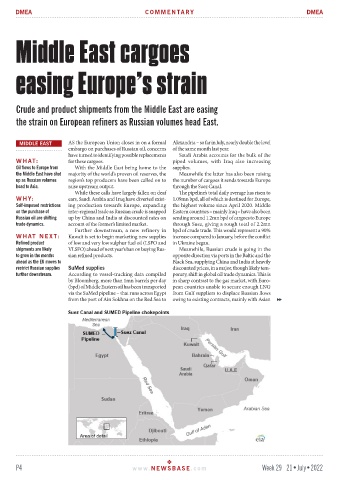

further downstream. According to vessel-tracking data compiled porary, shift in global oil trade dynamics. This is

by Bloomberg, more than 1mn barrels per day in sharp contrast to the gas market, with Euro-

(bpd) of Middle Eastern oil has been transported pean countries unable to secure enough LNG

via the SuMed pipeline – that runs across Egypt from Gulf suppliers to displace Russian flows

from the port of Ain Sokhna on the Red Sea to owing to existing contracts, mainly with Asian

P4 www. NEWSBASE .com Week 29 21•July•2022