Page 5 - MEOG Week 35 2021

P. 5

MEOG COMMENTARY MEOG

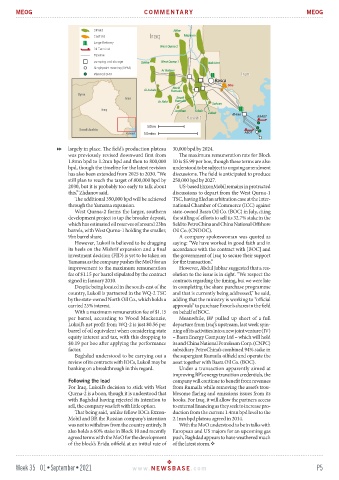

largely in place. The field’s production plateau 30,000 bpd by 2024.

was previously revised downward first from The maximum remuneration rate for Block

1.8mn bpd to 1.2mn bpd and then to 800,000 10 is $5.99 per boe, though these terms are also

bpd, though the timeline for the latest revision understood to be subject to ongoing amendment

has also been extended from 2025 to 2030. “We discussions. The field is anticipated to produce

still plan to reach the target of 800,000 bpd by 250,000 bpd by 2027.

2030, but it is probably too early to talk about US-based ExxonMobil remains in protracted

this,” Zhdanov said. discussions to depart from the West Qurna-1

The additional 350,000 bpd will be achieved TSC, having filed an arbitration case at the Inter-

through the Yamama expansion. national Chamber of Commerce (ICC) against

West Qurna-2 forms the larger, southern state-owned Basra Oil Co. (BOC) in July, citing

development project to tap the broader deposit, the stifling of efforts to sell its 32.7% stake in the

which has estimated oil reserves of around 23bn field to PetroChina and China National Offshore

barrels, with West Qurna-1 holding the smaller, Oil Co. (CNOOC).

9bn barrel share. A company spokeswoman was quoted as

However, Lukoil is believed to be dragging saying: “We have worked in good faith and in

its heels on the Mishrif expansion and a final accordance with the contract with [BOC] and

investment decision (FID) is yet to be taken on the government of Iraq to secure their support

Yamama as the company pushes the MoO for an for the transaction.”

improvement to the maximum remuneration However, Abdul Jabbar suggested that a res-

fee of $1.15 per barrel stipulated by the contract olution to the issue is in sight. “We respect the

signed in January 2010. contracts regarding the timing, but we were late

Despite being located in the south-east of the in completing the share purchase programme

country, Lukoil is partnered in the WQ-2 TSC and that is currently being addressed,” he said,

by the state-owned North Oil Co., which holds a adding that the ministry is working to “official

carried 25% interest. approvals” to purchase Exxon’s shares in the field

With a maximum remuneration fee of $1.15 on behalf of BOC.

per barrel, according to Wood Mackenzie, Meanwhile, BP pulled up short of a full

Lukoil’s net profit from WQ-2 is just $0.56 per departure from Iraq’s upstream, last week spin-

barrel of oil equivalent when considering state ning off its activities into a new joint venture (JV)

equity interest and tax, with this dropping to – Basra Energy Company Ltd – which will hold

$0.19 per boe after applying the performance its and China National Petroleum Corp. (CNPC)

factor. subsidiary PetroChina’s combined 94% stake in

Baghdad understood to be carrying out a the supergiant Rumaila oilfield and operate the

review of its contracts with IOCs, Lukoil may be asset together with Basra Oil Co. (BOC).

banking on a breakthrough in this regard. Under a transaction apparently aimed at

improving BP’s energy transition credentials, the

Following the lead company will continue to benefit from revenues

For Iraq, Lukoil’s decision to stick with West from Rumaila while removing the asset’s trou-

Qurna-2 is a boon, though it is understood that blesome flaring and emissions issues from its

with Baghdad having rejected its intention to books. For Iraq, it will allow the partners access

sell, the company was left with little option. to external financing as they seek to increase pro-

That being said, unlike fellow IOCs Exxon- duction from the current 1.4mn bpd level to the

Mobil and BP, the Russian company’s intention 2.1mn bpd plateau agreed in 2014.

was not to withdraw from the country entirely. It With the MoO understood to be in talks with

also holds a 60% stake in Block 10 and recently European and US majors for an upcoming gas

agreed terms with the MoO for the development push, Baghdad appears to have weathered much

of the block’s Eridu oilfield at an initial rate of of the latest storm.

Week 35 01•September•2021 www. NEWSBASE .com P5