Page 18 - Turkey Outlook 2022

P. 18

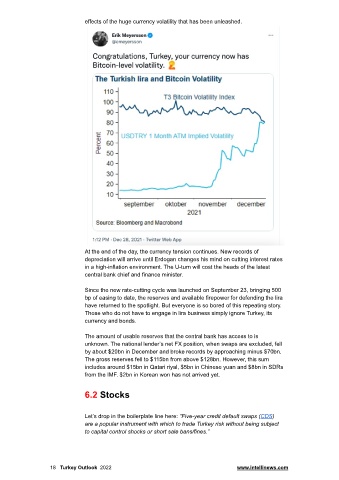

effects of the huge currency volatility that has been unleashed.

At the end of the day, the currency tension continues. New records of

depreciation will arrive until Erdogan changes his mind on cutting interest rates

in a high-inflation environment. The U-turn will cost the heads of the latest

central bank chief and finance minister.

Since the new rate-cutting cycle was launched on September 23, bringing 500

bp of easing to date, the reserves and available firepower for defending the lira

have returned to the spotlight. But everyone is so bored of this repeating story.

Those who do not have to engage in lira business simply ignore Turkey, its

currency and bonds.

The amount of usable reserves that the central bank has access to is

unknown. The national lender’s net FX position, when swaps are excluded, fell

by about $20bn in December and broke records by approaching minus $70bn.

The gross reserves fell to $115bn from above $128bn. However, this sum

includes around $15bn in Qatari riyal, $5bn in Chinese yuan and $8bn in SDRs

from the IMF. $2bn in Korean won has not arrived yet.

6.2 Stocks

Let’s drop in the boilerplate line here: “Five-year credit default swaps (CDS)

are a popular instrument with which to trade Turkey risk without being subject

to capital control shocks or short sale bans/fines.”

18 Turkey Outlook 2022 www.intellinews.com