Page 13 - Turkey Outlook 2022

P. 13

Jul-21 TSKB $192 130% 367-day $55 €116

Jun-21 ING Turkey $300 - 367-day $37 Libor+2.50% €269 Euribor+2.25%

Jun-21 Denizbank $410 new 367-day $103 €222 364-day Chinese yuan 245mn

May-21 Isbank (ISCTR) $965 121% 367-day $300 Libor+2.50% €545 Euribor+2.25%

May-21 Garanti (GARAN) $638 91% 367-day $279 Libor+2.50% €294 Euribor+2.25%

May-21 Yapi Kredi (YKBNK) $962 103% 367-day $351 Libor+2.50% €501 Euribor+2.25%

May-21 QNB Finansbank $335 131% 367-day $97 Libor+2.50% €197 Euribor+2.25%

May-21 Eximbank $785 101% 367-day $218 Libor+2.75% €467 Euribor+2.50%

Apr-21 Vakifbank (VAKBN) $1,100 105% 367-day $238 Libor+2.50% €691 Euribor+2.25%

Apr-21 Ziraat Bank $1,332 125% 367-day $293 Libor+2.50% €873 Euribor+2.25%

Apr-21 Akbank $676 107% 367-day $345 Libor+2.50% €279 Euribor+2.25%

4.0 Real Economy

4.1 Retail

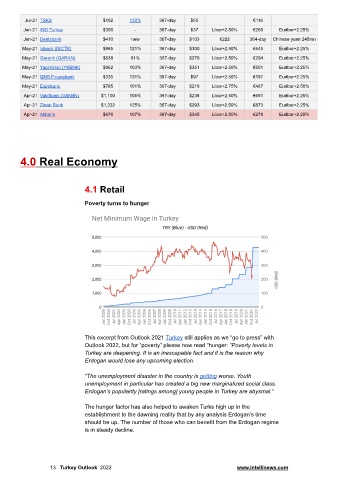

Poverty turns to hunger

This excerpt from Outlook 2021 Turkey still applies as we “go to press” with

Outlook 2022, but for “poverty” please now read “hunger: “Poverty levels in

Turkey are deepening. It is an inescapable fact and it is the reason why

Erdogan would lose any upcoming election.

“The unemployment disaster in the country is getting worse. Youth

unemployment in particular has created a big new marginalized social class.

Erdogan’s popularity [ratings among] young people in Turkey are abysmal.”

The hunger factor has also helped to awaken Turks high up in the

establishment to the dawning reality that by any analysis Erdogan’s time

should be up. The number of those who can benefit from the Erdogan regime

is in steady decline.

13 Turkey Outlook 2022 www.intellinews.com