Page 12 - Turkey Outlook 2022

P. 12

It was in March 2021 that Erdogan fired his “orthodox” central bank governor.

More from the 2021 report: “Erdogan’s lickspittles now work to the suggestion

that ‘the people’ see actual inflation at a minimum 15%, but some mainstream

pundits talk of 30% at a minimum.”

On January 3, official inflation for December (end-2021) will be released. The

market assesses that the figure must be something around 30%.

The Inflation Research Group (ENAG), an independent body led by Istanbul

academics, gave a figure of 49.87% for November inflation. Its inflation for

end-2021 may come in the 60%s.

Domestic producer price index (PPI) inflation was released by TUIK at 46.31%

y/y, up from 43.96% in September.

If the speculation suggesting Erdogan wants a monthly mortgage rate of 1%

proves correct, a 12% policy rate (banks’ funding cost) would be below the

annual compound rate of around 13% that the 1% monthly mortgage rate

implies.

Some speculation suggests that Erdogan wants a single-digit policy rate.

On January 20, the first rate-setting meeting in 2022 will be held. Giving its last

rates decision on December 18, the central bank implied that it is planning to

keep the benchmark on hold in Q1.

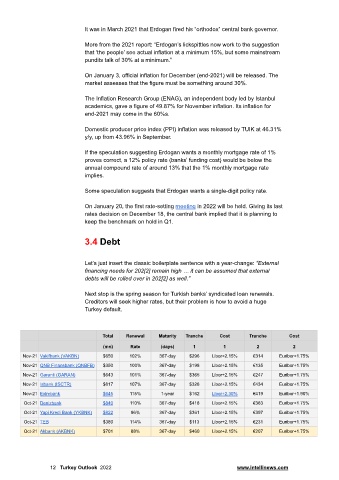

3.4 Debt

Let’s just insert the classic boilerplate sentence with a year-change: “External

financing needs for 202[2] remain high … it can be assumed that external

debts will be rolled over in 202[2] as well.”

Next stop is the spring season for Turkish banks’ syndicated loan renewals.

Creditors will seek higher rates, but their problem is how to avoid a huge

Turkey default.

Total Renewal Maturity Tranche Cost Tranche Cost

(mn) Rate (days) 1 1 2 2

Nov-21 Vakifbank (VAKBN) $650 102% 367-day $296 Libor+2.15% €314 Euribor+1.75%

Nov-21 QNB Finansbank (QNBFB) $350 100% 367-day $198 Libor+2.15% €135 Euribor+1.75%

Nov-21 Garanti (GARAN) $643 101% 367-day $365 Libor+2.15% €247 Euribor+1.75%

Nov-21 Isbank (ISCTR) $817 107% 367-day $328 Libor+2.15% €434 Euribor+1.75%

Nov-21 Eximbank $645 115% 1-year $162 Libor+2.30% €419 Euribor+1.90%

Oct-21 Denizbank $840 110% 367-day $418 Libor+2.15% €363 Euribor+1.75%

Oct-21 Yapi Kredi Bank (YKBNK) $822 96% 367-day $361 Libor+2.15% €397 Euribor+1.75%

Oct-21 TEB $380 114% 367-day $113 Libor+2.15% €231 Euribor+1.75%

Oct-21 Akbank (AKBNK) $701 88% 367-day $460 Libor+2.15% €207 Euribor+1.75%

12 Turkey Outlook 2022 www.intellinews.com