Page 5 - MEOG Week 07 2023

P. 5

MEOG COMMENTARY MEOG

a $121mn deal in late 2019 to upgrade facilities production, and development of oil and gas.”

and increase the capture of flare gas at the field. They will “work together on a range of initia-

WQ-1 has a current capacity of 550,000 bar- tives, including the exchange of technical exper-

rels per day (bpd) of oil along with at least 150mn tise, the joint exploration of oil and gas fields, and

cubic feet (4.25mn cubic metres) per day of asso- the development of new projects in the energy

ciated gas. sector”, while a framework has also been estab-

In June, BOC signed a contract with Exxon- lished for research and technology transfer.

Mobil and fellow American firm Schlumberger BOC and NISOC have considerable upside

to drill 96 wells allowing for an increase in out- in liaising with each other in these areas given

put capacity to 700,000 bpd, and the Iraqi firm that Basra accounts for a significant portion of

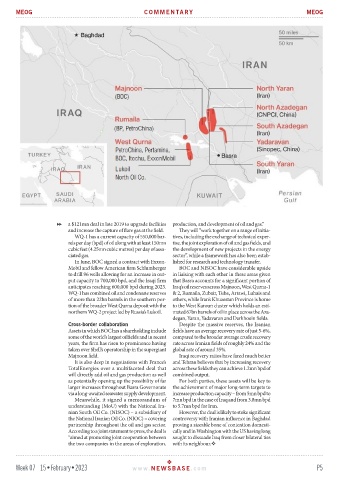

anticipates reaching 600,000 bpd during 2023. Iraq’s oil reserves across Majnoon, West Qurna-1

WQ-1 has combined oil and condensate reserves & 2, Rumaila, Zubair, Tuba, Artawi, Luhais and

of more than 22bn barrels in the southern por- others, while Iran’s Khuzestan Province is home

tion of the broader West Qurna deposit with the to the West Karoun cluster which holds an esti-

northern WQ-2 project led by Russia’s Lukoil. mated 67bn barrels of oil in place across the Aza-

degan, Yaran, Yadavaran and Darkhoein fields.

Cross-border collaboration Despite the massive reserves, the Iranian

Assets in which BOC has a shareholding include fields have an average recovery rate of just 5-6%,

some of the world’s largest oilfields and in recent compared to the broader average crude recovery

years, the firm has risen to prominence having rate across Iranian fields of roughly 24% and the

taken over Shell’s operatorship in the supergiant global rate of around 35%.

Majnoon field. Iraqi recovery ratios have fared much better

It is also deep in negotiations with France’s and Tehran believes that by increasing recovery

TotalEnergies over a multifaceted deal that across these fields they can achieve 1.2mn bpd of

will directly add oil and gas production as well combined output.

as potentially opening up the possibility of far For both parties, these assets will be key to

larger increases throughout Basra Governorate the achievement of major long-term targets to

via a long-awaited seawater supply development. increase production capacity – from 5mn bpd to

Meanwhile, it signed a memorandum of 7mn bpd in the case of Iraq and from 3.8mn bpd

understanding (MoU) with the National Ira- to 5.7mn bpd for Iran.

nian South Oil Co. (NISOC) – a subsidiary of However, the deal is likely to stoke significant

the National Iranian Oil Co. (NIOC) – covering controversy with Iranian influence in Baghdad

partnership throughout the oil and gas sector. proving a sizeable bone of contention domesti-

According to a joint statement to press, the deal is cally and in Washington with the US having long

“aimed at promoting joint cooperation between sought to dissuade Iraq from closer bilateral ties

the two companies in the areas of exploration, with its neighbour.

Week 07 15•February•2023 www. NEWSBASE .com P5