Page 5 - AsianOil Week 09 2023

P. 5

AsianOil COMMENTARY AsianOil

Crude oil prices

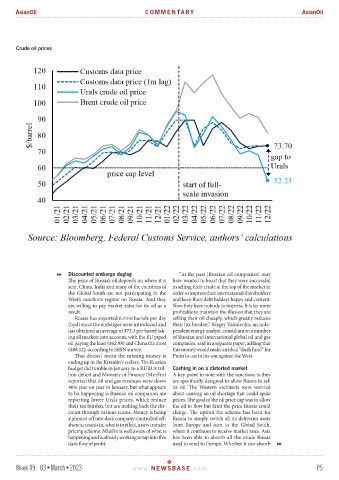

Discounted embargo dogleg “In the past [Russian oil companies] may

The price of Russia’s oil depends on where it is have wanted to boast that they were successful

sent. China, India and many of the countries of in selling their crude at the top of the market in

the Global South are not participating in the order to impress their international shareholders

West’s sanctions regime on Russia. And they and keep their debt holders happy and content.

are willing to pay market rates for its oil as a Now they have nobody to impress. It is far more

result. profitable to maintain the illusion that they are

Russia has exported 6.1mn barrels per day selling their oil cheaply, which greatly reduces

(bpd) since the embargos were introduced and their tax burden,” Sergey Vakulenko, an inde-

has obtained an average of $73.3 per barrel tak- pendent energy analyst, consultant to a number

ing all markets into account, with the EU piped of Russian and international global oil and gas

oil paying the least ($62.98) and China the most companies, said in a separate paper, adding that

($88.12), according to SSRN survey. this money would make an ideal “slush fund” for

That doesn't mean the missing money is Putin to use in his war against the West.

ending up in the Kremlin's coffers. The Russian

budget did tumble in January to a RUB1.8 tril- Cashing in on a distorted market

lion deficit and Ministry of Finance (MinFin) A key point to note with the sanctions is they

reported that oil and gas revenues were down are specifically designed to allow Russia to sell

46% year on year in January, but what appears its oil. The Western architects were worried

to be happening is Russia’s oil companies are about causing an oil shortage that could spike

reporting lower Urals prices, which reduce prices. The goal of the oil price cap was to allow

their tax burden, but are making back the dis- the oil to flow but limit the price Russia could

count through various scams. Money is being charge. The upshot the scheme has been for

siphoned off into dark company-controlled off- Russia to simply switch all its deliveries away

shore accounts in, what is in effect, a new transfer from Europe and turn to the Global South,

pricing scheme. MinFin is well aware of what is where it continues to receive market rates. Asia

happening and is already working to tap into this has been able to absorb all the crude Russia

dark flow of profit. used to send to Europe. Whether it can absorb

Week 09 03•March•2023 www. NEWSBASE .com P5