Page 10 - MEOG Week 02 2022

P. 10

MEOG PROJECTS & COMPANIES MEOG

Iraq to take control of Exxon’s stake at WQ-1

IRAQ IRAQ’S Ministry of Oil (MoO) last week said This was turned down by BOC, with a source

that the recently re-established Iraqi National Oil close to proceedings telling MEOG in mid-2021

Co. (INOC) would take control of ExxonMobil’s that the Iraqi government did not want the coun-

stake in the West Qurna-1 (WQ-1) oilfield. try’s upstream to be “dominated by Chinese

If completed, it will bring to an end more than companies”.

a year of back and forth between Iraqi authorities The developers are paid a maximum of just

and the US super-major which had previously $1.9 per barrel of oil produced from the asset –

lined up Chinese buyers for the 32.7% operated less than $1.2 per barrel after deduction of taxes

share. – under a 20-year technical services contract

On January 5, Oil Minister Ihsan Abdul Jab- (TSC) signed in 2010. It is worth noting that the

bar said that the cabinet had “approved the Iraqi WQ-1 TSC also does not cover gas production,

National Oil Company’s acquisition of Exxon- with China Petroleum Engineering & Construc-

Mobil’s share in West Qurna-1” without provid- tion Corp. (CPECC) awarded a $121mn deal in

ing any further details. late 2019 to upgrade facilities and increase the

Any deal will likely involve some wrangling capture of flare gas at the field.

around the transaction fee. Middle East Oil & In Q4, reports emerged that a proposal had

Gas (MEOG) understands that the technical been submitted to the MoO for US services spe-

services contract (TSC) for WQ-1 does not con- cialist Halliburton and the UK’s Wood Group

tain any provision for the sale of a stake in the to operate the field with financial backing from

asset, rather that ExxonMobil would be entitled US investment firm Twelve Seas Investment Co.

to compensation to recover capital expenditure However, Halliburton quashed these rumours in

related to the project, were it to be replaced. early December, saying “we are not buying any

ExxonMobil has divested nearly half of its fields”.

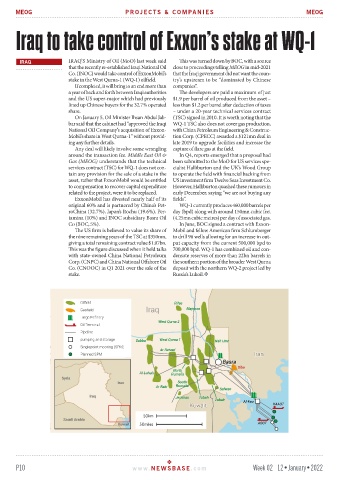

original 60% and is partnered by China’s Pet- WQ-1 currently produces 460,000 barrels per

roChina (32.7%), Japan’s Itochu (19.6%), Per- day (bpd) along with around 150mn cubic feet

tamina (10%) and INOC subsidiary Basra Oil (4.25mn cubic metres) per day of associated gas.

Co (BOC, 5%). In June, BOC signed a contract with Exxon-

The US firm is believed to value its share of Mobil and fellow American firm Schlumberger

the nine remaining years of the TSC at $350mn, to drill 96 wells allowing for an increase in out-

giving a total remaining contract value $1.07bn. put capacity from the current 500,000 bpd to

This was the figure discussed when it held talks 700,000 bpd. WQ-1 has combined oil and con-

with state-owned China National Petroleum densate reserves of more than 22bn barrels in

Corp. (CNPC) and China National Offshore Oil the southern portion of the broader West Qurna

Co. (CNOOC) in Q1 2021 over the sale of the deposit with the northern WQ-2 project led by

stake. Russia’s Lukoil.

P10 www. NEWSBASE .com Week 02 12•January•2022