Page 5 - MEOG Week 10 2022

P. 5

MEOG COMMENTARY MEOG

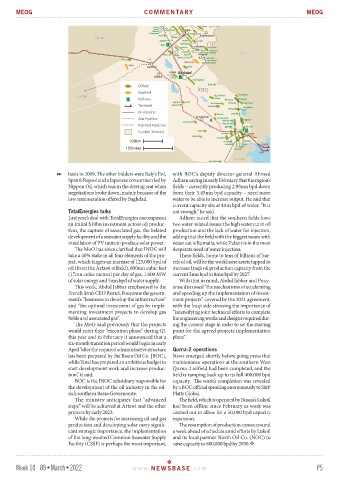

basis in 2009. The other bidders were Italy’s Eni, with BOC’s deputy director-general Ahmed

Spain’s Repsol and a Japanese consortium led by Adhem saying in early February that the region’s

Nippon Oil, which was in the driving seat when fields – currently producing 2.95mn bpd down

negotiations broke down, mainly because of the from their 3.45mn bpd capacity – need more

low remuneration offered by Baghdad. water to be able to increase output. He said that

current capacity sits at 4mn bpd of water. “It is

TotalEnergies talks not enough,” he said.

Last year’s deal with TotalEnergies encompasses Adhem noted that the southern fields have

an initial $10bn investment across oil produc- two water-related issues: the high water cut in oil

tion, the capture of associated gas, the belated production and the lack of water for injection,

development of a seawater supply facility and the adding that the field with the biggest issues with

installation of PV units to produce solar power. water cut is Rumaila, while Zubair is in the most

The MoO has since clarified that INOC will desperate need of water injection.

take a 40% stake in all four elements of the pro- These fields, home to tens of billions of bar-

ject, which targets an increase of 125,000 bpd of rels of oil, will be the workhorse assets tapped to

oil (from the Artawi oilfield), 600mn cubic feet increase Iraq’s oil production capacity from the

(17mn cubic metres) per day of gas, 1,000 MW current 5mn bpd to 8mn bpd by 2027.

of solar energy and 5mn bpd of water supply. With that in mind, Abdul Jabbar and Pouy-

This week, Abdul Jabbar emphasised to the anne discussed “the mechanisms of accelerating

French firm’s CEO Patrick Pouyanne the govern- and speeding up the implementation of invest-

ment’s “keenness to develop the infrastructure” ment projects” covered by the 2021 agreement,

and “the optimal investment of gas by imple- with the Iraqi side stressing the importance of

menting investment projects to develop gas “intensifying joint technical efforts to complete

fields and associated gas”. the engineering works and designs required dur-

The MoO said previously that the projects ing the current stage in order to set the starting

would enter their “execution phase” during Q1 point for the agreed projects implementation

this year and in February it announced that a plans”.

six-month transition period would begin in early

April “after the required administrative structure Qurna-2 operations

has been prepared by the Basra Oil Co. [BOC], News emerged shortly before going press that

while Total has prepared an ambitious budget to maintenance operations at the southern West

start development work and increase produc- Qurna-2 oilfield had been completed, and the

tion,” it said. field is ramping back up to its full 400,000 bpd

BOC is the INOC subsidiary responsible for capacity. The work’s completion was revealed

the development of the oil industry in the oil- by a BOC official speaking anonymously to S&P

rich southern Basra Governorate. Platts Global.

The ministry anticipates that “advanced The field, which is operated by Russia’s Lukoil

steps” will be achieved at Artawi and the other had been offline since February as work was

projects by early 2023. carried out to allow for a 50,000 bpd capacity

While the projects for increasing oil and gas expansion.

production and developing solar carry signifi- The resumption of production comes around

cant strategic importance, the implementation a week ahead of schedule amid efforts by Lukoil

of the long-awaited Common Seawater Supply and its local partner North Oil Co. (NOC) to

Facility (CSSF) is perhaps the most important, raise capacity to 800,000 bpd by 2030.

Week 10 09•March•2022 www. NEWSBASE .com P5