Page 5 - FSU OGM Week 26 2021

P. 5

FSUOGM COMMENTARY FSUOGM

may also jeopardise energy security during the recently, however. The US Biden administra-

next winter. tion in May waived additional sanctions against

Gas prices are typically higher in winter and the pipeline, a move widely perceived as a tacit

lower in summer, giving companies an incentive admission that the US can do little to thwart the

to store more volumes during the hotter months project. Germany, an ardent supporter of Nord

of the year. But this year is anything but typical, Stream 2, is set to approve its launch later this

owing to the continuing impact of the coronavi- year. It is expected that Biden will at some point

rus. With companies having no reason to with- ease the existing sanctions against Nord Stream

hold gas from the market and place it in storage, 2, possibly after trilateral talks with Moscow and

European storage utilisation is at an unusually Berlin.

low level. High gas prices and low storage levels

Worst still, prices could climb further in the strengthen the case for EU authorities to per-

coming months as Gazprom closes some of its mit the project. However, if the pipeline really

export pipelines for scheduled maintenance in is the motive for Gazprom withholding supply,

June and July. TurkStream is already offline for the company risks convincing the EU that the

repairs, and will not return to operation until threat that Russia poses to energy security is far

June 29. Meanwhile, Nord Stream 1 is due to halt too great, giving the bloc a rational to restrict the

shipments between July 13 and 25. pipeline.

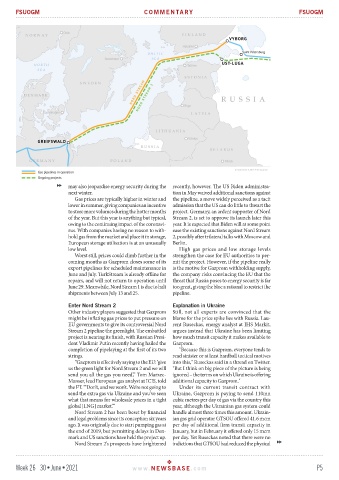

Enter Nord Stream 2 Explanation in Ukraine

Other industry players suggested that Gazprom Still, not all experts are convinced that the

might be inflating gas prices to put pressure on blame for the price spike lies with Russia. Lau-

EU governments to give its controversial Nord rent Ruseckas, energy analyst at IHS Markit,

Stream 2 pipeline the greenlight. The embattled argues instead that Ukraine has been limiting

project is nearing its finish, with Russian Presi- how much transit capacity it makes available to

dent Vladimir Putin recently having hailed the Gazprom.

completion of pipelaying at the first of its two "Because this is Gazprom, everyone tends to

strings. read sinister or at least hardball tactical motives

“Gazprom is effectively saying to the EU: ‘give into this," Ruseckas said in a thread on Twitter.

us the green light for Nord Stream 2 and we will "But I think on big piece of the picture is being

send you all the gas you need’,” Tom Marzec- ignored – the terms on which Ukraine is offering

Manser, lead European gas analyst at ICIS, told additional capacity to Gazprom."

the FT. “‘Don’t, and we won’t. We’re not going to Under its current transit contract with

send the extra gas via Ukraine and you’ve seen Ukraine, Gazprom is paying to send 110mn

what that means for wholesale prices in a tight cubic metres per day of gas via the country this

global [LNG] market.’” year, although the Ukrainian gas system could

Nord Stream 2 has been beset by financial handle almost three times this amount. Ukrain-

and legal problems since its conception six years ian gas grid operator GTSOU offered 41.6 mcm

ago. It was originally due to start pumping gas at per day of additional firm transit capacity in

the end of 2019, but permitting delays in Den- January, but in February it offered only 15 mcm

mark and US sanctions have held the project up. per day. Yet Ruseckas noted that there were no

Nord Stream 2’s prospects have brightened indictions that GTSOU had reduced the physical

Week 26 30•June•2021 www. NEWSBASE .com P5