Page 8 - FSU OGM Week 26 2021

P. 8

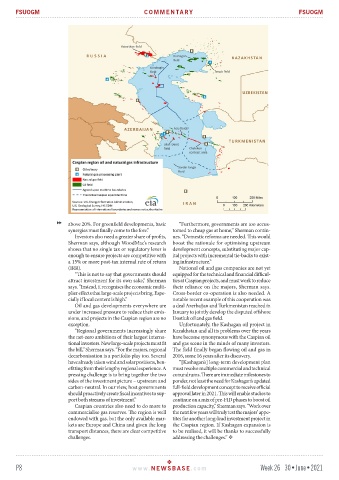

FSUOGM COMMENTARY FSUOGM

above 20%. For greenfield developments, basic “Furthermore, governments are too accus-

synergies must finally come to the fore.” tomed to cheap gas at home,” Sherman contin-

Investors also need a greater share of profits, ues. “Domestic reforms are needed. This would

Sherman says, although WoodMac’s research boost the rationale for optimising upstream

shows that no single tax or regulatory lever is development concepts, substituting major cap-

enough to ensure projects are competitive with ital projects with incremental tie-backs to exist-

a 15% or more post-tax internal rate of return ing infrastructure.”

(IRR). National oil and gas companies are not yet

“This is not to say that governments should equipped for the technical and financial difficul-

attract investment for its own sake,” Sherman ties at Caspian projects, and must work to reduce

says. “Instead, it recognises the economic multi- their reliance on the majors, Sherman says.

plier effects that large-scale projects bring. Espe- Cross-border co-operation is also needed. A

cially if local content is high.” notable recent example of this cooperation was

Oil and gas developments everywhere are a deal Azerbaijan and Turkmenistan reached in

under increased pressure to reduce their emis- January to jointly develop the disputed offshore

sions, and projects in the Caspian region are no Dostluk oil and gas field.

exception. Unfortunately, the Kashagan oil project in

“Regional governments increasingly share Kazakhstan and all its problems over the years

the net-zero ambitions of their largest interna- have become synonymous with the Caspian oil

tional investors. New large-scale projects must fit and gas scene in the minds of many investors.

the bill,” Sherman says. “For the majors, regional The field finally began flowing oil and gas in

decarbonisation is a portfolio play too. Several 2016, some 16 years after its discovery.

have already taken wind and solar positions, ben- “[Kashagan’s] long-term development plan

efitting from their lengthy regional experience. A must resolve multiple commercial and technical

pressing challenge is to bring together the two conundrums. There are immediate milestones to

sides of the investment picture – upstream and ponder, not least the need for Kashagan’s updated

carbon-neutral. In our view, host governments full-field development concept to receive official

should proactively create fiscal incentives to sup- approval later in 2021. This will enable studies to

port both streams of investment.” continue on a mix of pre-FID phases to boost oil

Caspian countries also need to do more to production capacity,” Sherman says. “Work over

commercialise gas reserves. The region is well the next few years will truly test the majors’ appe-

endowed with gas, but the only available mar- tites for another long-lead investment project in

kets are Europe and China and given the long the Caspian region. If Kashagan expansion is

transport distances, there are clear competitive to be realised, it will be thanks to successfully

challenges. addressing the challenges.”

P8 www. NEWSBASE .com Week 26 30•June•2021