Page 9 - AsianOil Week 22

P. 9

AsianOil EAST ASIA AsianOil

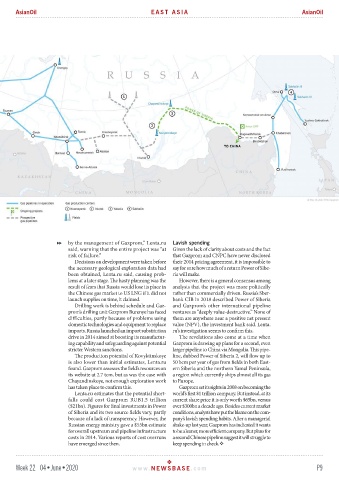

by the management of Gazprom,” Lenta.ru Lavish spending

said, warning that the entire project was “at Given the lack of clarity about costs and the fact

risk of failure.” that Gazprom and CNPC have never disclosed

Decisions on development were taken before their 2014 pricing agreement, it is impossible to

the necessary geological exploration data had say for sure how much of a return Power of Sibe-

been obtained, Lenta.ru said, causing prob- ria will make.

lems at a later stage. The hasty planning was the However, there is a general consensus among

result of fears that Russia would lose its place in analysts that the project was more politically

the Chinese gas market to US LNG if it did not rather than commercially driven. Russia’s Sber-

launch supplies on time, it claimed. bank CIB in 2018 described Power of Siberia

Drilling work is behind schedule and Gaz- and Gazprom’s other international pipeline

prom’s drilling unit Gazprom Burenye has faced ventures as “deeply value-destructive.” None of

difficulties, partly because of problems using them are anywhere near a positive net present

domestic technologies and equipment to replace value (NPV), the investment bank said. Lenta.

imports. Russia launched an import substitution ru’s investigation seems to confirm this.

drive in 2014 aimed at boosting its manufactur- The revelations also come at a time when

ing capability and safeguarding against potential Gazprom is drawing up plans for a second, even

stricter Western sanctions. larger pipeline to China via Mongolia. This pipe-

The production potential of Kovyktinskoye line, dubbed Power of Siberia 2, will flow up to

is also lower than initial estimates, Lenta.ru 50 bcm per year of gas from fields in both East-

found. Gazprom assesses the field’s resources on ern Siberia and the northern Yamal Peninsula,

its website at 2.7 tcm, but as was the case with a region which currently ships almost all its gas

Chayandinskoye, not enough exploration work to Europe.

has taken place to confirm this. Gazprom set its sights in 2008 on becoming the

Lenta.ru estimates that the potential short- world’s first $1 trillion company. But instead, at its

falls could cost Gazprom RUB1.5 trillion current share price it is only worth $65bn, versus

($21bn). Figures for final investments in Power over $300bn a decade ago. Besides current market

of Siberia and its two source fields vary, partly conditions, analysts have put the blame on the com-

because of a lack of transparency. However, the pany’s lavish spending habits. After a managerial

Russian energy ministry gave a $55bn estimate shake-up last year, Gazprom has indicated it wants

for overall upstream and pipeline infrastructure to be a leaner, more efficient company. But plans for

costs in 2014. Various reports of cost overruns a second Chinese pipeline suggest it will struggle to

have emerged since then. keep spending in check.

Week 22 04•June•2020 www. NEWSBASE .com P9