Page 9 - AfrOil Week 12 2023

P. 9

AfrOil INVESTMENT AfrOil

They also encompass holdings in the nationalise ExxonMobil’s assets is part of a wider

Chad-Cameroon pipeline, which exports oil effort to assert more control over resources and

from Chad to the Atlantic coast. revenue. The government has been pursuing

Chad, which has the 10th largest reserves contract renegotiations with foreign oil corpo-

in Africa, exports 90% of its oil. The move to rations to augment its portion of revenue.

KPC secures better terms for $350mn loan

KENYA STATE-OWNED Kenya Pipeline Co. (KPC) liabilities are due for payment, or both.

expects to increase profitability and retain more Securing the better terms comes when KPC

cash following the restructuring of syndicated continues to be among the most profitable and

loan terms with commercial banks, a develop- cash-rich state-owned companies, albeit with

ment that will see the company pay lower inter- management problems and is among parastatals

est rates on a $350mn facility secured in 2015. lined for privatisation.

KPC, which is one of the state-owned com- In February, the government reappointed

panies being lined up for privatisation, revealed Joe Sang as KPC boss but the appointment was

that it has renegotiated for better terms with revoked by the High Court. Sang was forced out

commercial banks which financed the recently of office in December 2018 following corruption

built Mombasa-Nairobi pipeline (Line 5) that allegations but was acquitted last year.

has significantly improved petroleum product In the financial year ended on June 30, 2021,

transportation in Kenya’s hinterlands and to the cash-rich company posted $52mn in pre-

neighbouring countries. tax profits, which was attributable to improved

The banks were the Co-operative Bank of throughput performance and cost containment.

Kenya, CfC Stanbic, Citibank NA, Commercial The company’s cash reserves went up by 13.8%

Bank of Africa (now NCBA), Standard Char- to $72.5mn compared to $63.4mn in 2020.

tered Bank and Rand Merchant Bank. During the year, KPC recorded a 6% growth

“The company was able to renegotiate for in throughput volumes to 8.11mn cubic metres,

favourable syndicated loan terms which will up from 7.6 mcm in 2019/2020. On the domes-

lead to future cash position due to low-interest tic throughput front, the figures went up by 7%,

payments,” media outlet The Nation quoted the rising from 4.19 mcm to 4.47 mcm.

company as saying. Outside Kenya, KPC transports petroleum

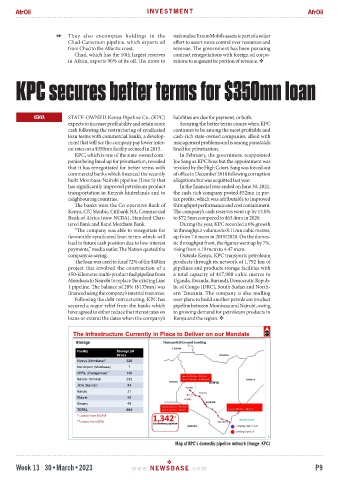

The loan was used to fund 72% of the $484m products through its network of 1,792 km of

project that involved the construction of a pipelines and products storage facilities with

450-kilometre multi-product fuel pipeline from a total capacity of 417,980 cubic metres to

Mombasa to Nairobi to replace the existing Line Uganda, Rwanda, Burundi, Democratic Repub-

1 pipeline. The balance of 28% ($135mn) was lic of Congo (DRC), South Sudan and North-

financed using the company’s internal resources. ern Tanzania. The company is also mulling

Following the debt restructuring, KPC has over plans to build another petroleum product

secured a major relief from the banks which pipeline between Mombasa and Nairobi, owing

have agreed to either reduce the interest rates on to growing demand for petroleum products in

loans or extend the dates when the company’s Kenya and the region.

Map of KPC’s domestic pipeline network (Image: KPC)

Week 13 30•March•2023 www. NEWSBASE .com P9