Page 6 - LatAmOil Week 21 2022

P. 6

LatAmOil COMMENTARY LatAmOil

After all, many USGC refineries are set up to flows that would see additional volumes of US

handle heavy crudes of the type produced by oil moving into Europe.

Venezuela, and they have not been able to buy If so, it would probably be those extra barrels

from their former main supplier for the last few that helped the Continent overcome the disrup-

years. tions arising from the Russian war on Ukraine –

If Eni and Repsol (and eventually Chev- not Venezuelan production per se, but a shift in

ron, assuming that it is able to move past the global trade flows that involved both Venezue-

negotiation stage) started moving Venezuelan lan and US crude against a backdrop of contrib-

oil into the US market, they would not really uting factors. This shift is not likely to happen

displace any US oil production. As previously quickly, though, as Venezuela’s oil sector is still

mentioned, many USGC refineries are set up not in a position to make up for the loss of 20%

to process heavy sours rather than light sweets, of Russia exports to Europe – especially since

and most US barrels consist of light sweets. that number is likely to grow bigger as the EU

However, having extra supplies coming into the moves ahead with plans to reduce reliance on

USGC region might help support a shift in trade Russian energy.

MEXICO

CNH authorises Pemex subsidiary to drill

Popoca-1EXP well at AE-0149-M-Uchukil

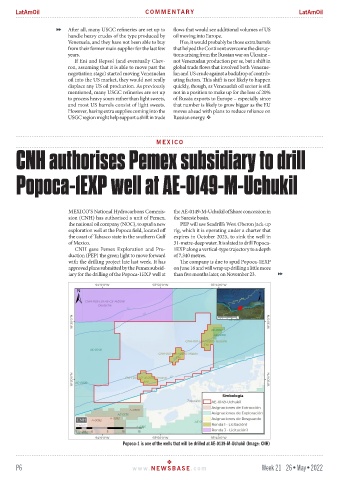

MEXICO’S National Hydrocarbons Commis- the AE-0149-M-Uchukil offshore concession in

sion (CNH) has authorised a unit of Pemex, the Sureste basin.

the national oil company (NOC), to spud a new PEP will use Seadrill’s West Oberon jack-up

exploration well at the Popoca field, located off rig, which it is operating under a charter that

the coast of Tabasco state in the southern Gulf expires in October 2025, to sink the well in

of Mexico. 31-metre-deep water. It is slated to drill Popoca-

CNH gave Pemex Exploration and Pro- 1EXP along a vertical-type trajectory to a depth

duction (PEP) the green light to move forward of 7,340 metres.

with the drilling project late last week. It has The company is due to spud Popoca-1EXP

approved plans submitted by the Pemex subsid- on June 16 and will wrap up drilling a little more

iary for the drilling of the Popoca-1EXP well at than five months later, on November 23.

Popoca-1 is one of the wells that will be drilled at AE-0139-M-Uchukil (Image: CNH)

P6 www. NEWSBASE .com Week 21 26•May•2022