Page 13 - DMEA Week 13 2021

P. 13

DMEA FINANCE & INVESTMENT DMEA

Aramco asks banks to

finance pipeline deal

MIDDLE EAST STATE-OWNED Saudi Aramco is reported to proposed by Aramco were aggressive, reflecting

have sent a request for proposals (RFP) to a pool improved liquidity in the banking sector and an

of banks for funding that it intends to provide to appetite for deals. BlackRock, Brookfield Asset

companies considering leasing a stake in its oil Management, KKR & Co,. Apollo Global Man-

pipelines division. agement Inc. and Chinese state-backed Silk

Sources working on the deal told Reuters this Road Fund Co. and China Investment Corp.

week that the RFP was sent to Aramco’s ‘relation- have all been reported as potential bidders.

ship banks’, those that have previously provided Meanwhile, negotiations are also understood

lending to the company. to have been carried out between Aramco and a

They added that the financing could be worth group of local banks including Al-Ahli NCB, Al

up to $10bn, putting it on a par with the $10.1bn Rajhi, Riyad and Samba. These banks are likely to

Abu Dhabi National Oil Co. (ADNOC) received be among those who received the RFP.

from a consortium in June 2020 in exchange for The state oil giant has enjoyed a newfound

leasing out a 49% in the ADNOC Gas Pipelines relationship with debt markets over the past year

and significantly more than the $4.9bn Black- or two, taking out $18bn in to cover part of its

Rock and KKR spent to lease a 40% stake in $69bn acquisition of a majority stake in Saudi

ADNOC Oil Pipelines months earlier. Basic Industries Corp. (SABIC) and to maintain

Aramco is being advised by JPMorgan and its ongoing $18.75bn per quarter dividend com-

Japan’s MUFG on the novel deal, dubbed inter- mitment to shareholders.

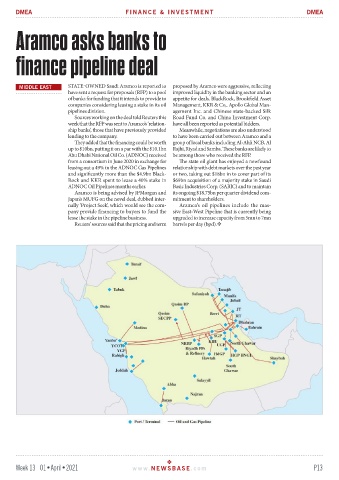

nally ‘Project Seek’, which would see the com- Aramco’s oil pipelines include the mas-

pany provide financing to buyers to fund the sive East-West Pipeline that is currently being

lease the stake in the pipeline business. upgraded to increase capacity from 5mn to 7mn

Reuters’ sources said that the pricing and term barrels per day (bpd).

Week 13 01•April•2021 www. NEWSBASE .com P13