Page 12 - MEOG Week 01 2021

P. 12

MEOG TENDERS MEOG

Aramco awards Zuluf EPC contracts

SAUDI ARABIA SAUDI Aramco last week awarded five major awarded three EPC and installation (EPCI) con-

engineering, procurement and construction tracts covering four drilling jackets and seven oil

(EPC) contracts worth more than $4.5bn for production deck modules (PDMs) at the Abu

work on the Zuluf crude increment programme. Sa’fah, Safaniyah, and Zuluf fields – and Zuluf’s

The project is expected to add 600,000 bar- Ribyan reservoir.

rels per day of Arabian Heavy capacity to Zuluf’s It added that the three contract release pur-

existing maximum sustainable capacity (MSC) chase orders (CRPOs) also cover more than 45

of 825,000 bpd by 2026. km of pipelines, more than 100 km of subsea

Though only the UAE’s National Petroleum cables and tie-in works to existing facilities.

Construction Co. (NPCC) has publicly acknowl- Aramco launched the several tenders for the

edged the award of two packages – in a statement delayed Zuluf programme in April last year, cov-

to the Abu Dhabi Securities Exchange (ADX) – ering the more than 60% of the project’s overall

Middle East Oil & Gas (MEOG) understands $8bn value.

that American firm McDermott and a consor- The tenders were opened up to the pool of

tium of India’s Larsen & Toubro and Oslo-listed signatories to Aramco’s so-called long-term

Subsea 7 also picked up work. agreements (LTAs) in which the winning con-

NPCC’s three-year, $2.23bn deal for packages tractors are joined by Dynamic Industries of the

four and five covers wellhead topsides, tie-in US, Italy’s Saipem, China Offshore Oil Engineer-

platforms, an electrical distribution platform ing Co. (COOEC), UAE-based Lamprell with

and associated pipelines and cabling. Boskalis of the Netherlands, Malaysia’s Sapura

Meanwhile, sources at the contractor compa- Energy, UK-based TechnipFMC with Malaysia

nies told several industry publications that the Marine & Heavy Engineering and South Korea’s

first package – covering 42-inch (1,067-mm) oil Hyundai Heavy Industries.

trunklines – was awarded to McDermott, with Once on stream, the Zuluf expansion will

L&T and Subsea 7 winning packages two and contribute more than half of the planned 1mn

three, which cover water injection wellhead top- bpd capacity increase mandated by the King-

sides, three water injection tie-in platforms and dom’s Ministry of Energy in 2020, while 300,000

their associated pipes and cabling. bpd will be added by both the Khurais and Mar-

Formal announcements are expected to be jan increments, with another 250,000 bpd com-

made by McDermott and L&T-Subsea 7 by the ing from Berri.

end of January. These expansions will offset decline and see

In December, the American firm was Aramco’s MSC rise to 13mn bpd.

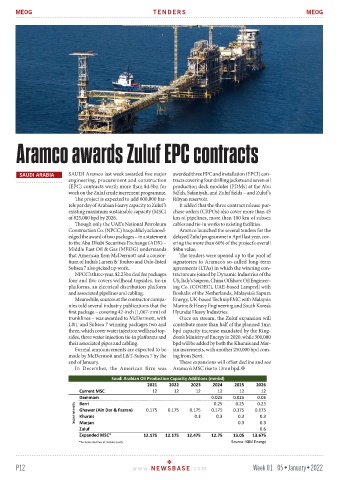

Saudi Arabian Oil Production Capacity Additions (mmbd)

2021 2022 2023 2024 2025 2026

Current MSC 12 12 12 12 12 12

Dammam 0.025 0.025 0.05

0.25

0.25

Berri

0.25

Increments Ghawar (Ain Dar & Fazran) 0.175 0.175 0.175 0.175 0.175 0.175

0.3

0.3

Khurais

0.3

0.3

Marjan

0.6

Zuluf 0.3 0.3

Expanded MSC* 12.175 12.175 12.475 12.75 13.05 13.675

*Excludes declines at mature assets Source: IGM Energy

P12 www. NEWSBASE .com Week 01 05•January•2022