Page 8 - MEOG Week 01 2021

P. 8

MEOG POLICY & SECURITY MEOG

OPEC picks new secretary

general as restrictions ease

OPEC OPEC this week elected its new secretary-gen- he said.

eral, voting in Kuwaiti industry veteran Haitham Al-Ghais’ appointment was welcomed by

al-Ghais, who will replace Nigerian Mohammed Saudi Energy Minister Prince Abdulaziz bin Sal-

Barkindo in August. man, who offered his “cordial congratulations”.

His election was announced a day before the Meanwhile, he was quoted by Al Arabiya as

group and its OPEC+ partners decided to pro- saying that he expects global oil demand to reach

ceed with their planned easing of output restric- pre-pandemic levels by the end of the year.

tions in February. With OPEC+ having been nervous about the

Al-Ghais told Reuters that supporting “the impact of the mutating coronavirus (COVID-

continuation of this Declaration of Co-opera- 19) when it last met, a JTC report on January 2

tion” into 2023 is one of his top priorities. played down the impact of the Omicron variant.

“It’s in the wider interest of the industry and It said Omicron “is expected to be mild

all the 23 countries that have signed up to this and short-lived, as the world becomes better

agreement,” he added, noting that he would work equipped to manage COVID-19 and its related

to “preserve and nurture” relations with Russia. challenges”, suggesting that the group was

The secretary-general-elect spoke of his unlikely to make any knee-jerk reactions.

“unwavering” commitment to the Joint Techni- This indeed turned out to be the case when

cal Committee (JTC) and the Joint Ministerial the group reached a quick decision on January

Monitoring Committee (JMMC). 4, proceeding with plans to ease production cuts

“I have hands-on experience of what the by a further 400,000 barrels per day (bpd) next

JTC does, what the JMMC does. I’ve attended month. However, with some members having

all these meetings since 2017, I haven’t missed struggled to reach their targets, only a fraction

a single meeting, even when I had a broken leg,” of this is seen making its way on to the market.

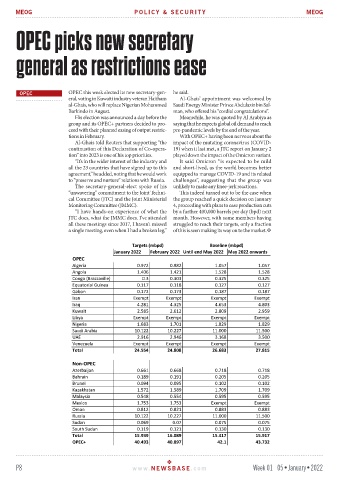

Targets (mbpd) Baseline (mbpd)

January 2022 February 2022 Until end May 2022 May 2022 onwards

OPEC

Algeria 0.972 0.982 1.057 1.057

Angola 1.406 1.421 1.528 1.528

Congo (Brazzaville) 0.3 0.303 0.325 0.325

Equatorial Guinea 0.117 0.118 0.127 0.127

Gabon 0.172 0.173 0.187 0.187

Iran Exempt Exempt Exempt Exempt

Iraq 4.281 4.325 4.653 4.803

Kuwait 2.585 2.612 2.809 2.959

Libya Exempt Exempt Exempt Exempt

Nigeria 1.683 1.701 1.829 1.829

Saudi Arabia 10.122 10.227 11.000 11.500

UAE 2.916 2.946 3.168 3.500

Venezuela Exempt Exempt Exempt Exempt

Total 24.554 24.808 26.683 27.815

Non-OPEC

Azerbaijan 0.661 0.668 0.718 0.718

Bahrain 0.189 0.191 0.205 0.205

Brunei 0.094 0.095 0.102 0.102

Kazakhstan 1.572 1.589 1.709 1.709

Malaysia 0.548 0.554 0.595 0.595

Mexico 1.753 1.753 Exempt Exempt

Oman 0.812 0.821 0.883 0.883

Russia 10.122 10.227 11.000 11.500

Sudan 0.069 0.07 0.075 0.075

South Sudan 0.119 0.121 0.130 0.130

Total 15.939 16.089 15.417 15.917

OPEC+ 40.493 40.897 42.1 43.732

P8 www. NEWSBASE .com Week 01 05•January•2022