Page 9 - FSUOGM Week 18 2021

P. 9

FSUOGM PERFORMANCE FSUOGM

Gazprom beats expectations,

posts a $5bn profit in Q4-2021

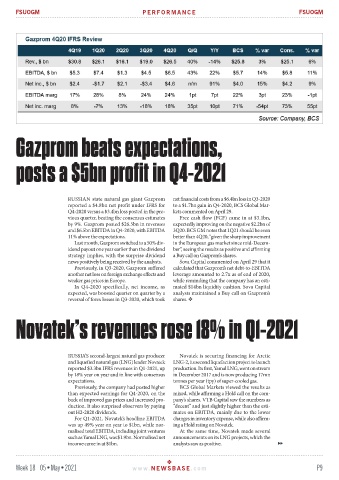

RUSSIAN state natural gas giant Gazprom net financial costs from a $6.4bn loss in Q3-2020

reported a $4.8bn net profit under IFRS for to a $1.7bn gain in Q4-2020, BCS Global Mar-

Q4-2020 versus a $3.4bn loss posted in the pre- kets commented on April 29.

vious quarter, beating the consensus estimates Free cash flow (FCF) came in at $3.1bn,

by 9%. Gazprom posted $26.5bn in revenues expectedly improving on the negative $2.2bn of

and $6.5bn EBITDA in Q4-2020, with EBITDA 3Q20. BCS GM notes that 1Q21 should be even

11% above the expectations. better than 4Q20, “given the sharp improvement

Last month, Gazprom switched to a 50% div- in the European gas market since mid-Decem-

idend payout one year earlier than the dividend ber”, seeing the results as positive and affirming

strategy implies, with the surprise dividend a Buy call on Gazprom’s shares.

news positively being received by the analysts. Sova Capital commented on April 29 that it

Previously, in Q3-2020, Gazprom suffered calculated that Gazprom’s net debt-to-EBITDA

another net loss on foreign exchange effects and leverage amounted to 2.7x as of end of 2020,

weaker gas prices in Europe. while reminding that the company has an esti-

In Q4-2020 specifically, net income, as mated $14bn liquidity cushion. Sova Capital

expected, was boosted quarter on quarter by a analysts maintained a Buy call on Gazprom’s

reversal of forex losses in Q3-2020, which took shares.

Novatek’s revenues rose 18% in Q1-2021

RUSSIA’S second-largest natural gas producer Novatek is securing financing for Arctic

and liquefied natural gas (LNG) leader Novatek LNG-2, its second liquefaction project to launch

reported $3.3bn IFRS revenues in Q1-2021, up production. Its first, Yamal LNG, went on stream

by 18% year on year and in line with consensus in December 2017 and is now producing 17mn

expectations. tonnes per year (tpy) of super-cooled gas.

Previously, the company had posted higher BCS Global Markets viewed the results as

than expected earnings for Q4-2020, on the mixed, while affirming a Hold call on the com-

back of improved gas prices and increased pro- pany’s shares. VTB Capital saw the numbers as

duction. It also surprised observers by paying “decent” and just slightly higher than the esti-

out H2-2020 dividends. mates on EBITDA, mainly due to the lower

For Q1-2021, Novatek’s headline EBITDA changes in inventory expense, while also affirm-

was up 49% year on year to $1bn, while nor- ing a Hold rating on Novatek.

malised total EBITDA, including joint ventures At the same time, Novatek made several

such as Yamal LNG, was $1.9bn. Normalised net announcements on its LNG projects, which the

income came in at $1bn. analysts saw as positive.

Week 18 05•May•2021 www. NEWSBASE .com P9