Page 6 - FSUOGM Week 05 2023

P. 6

FSUOGM COMMENTARY FSUOGM

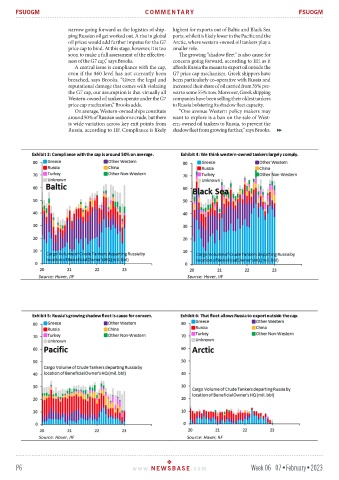

narrow going forward as the logistics of ship- highest for exports out of Baltic and Black Sea

ping Russian oil get worked out. A rise in global ports, while it is likely lower in the Pacific and the

oil prices would add further impetus for the G7 Arctic, where western-owned oil tankers play a

price cap to bind. At this stage, however, it is too smaller role.

soon to make a full assessment of the effective- The growing “shadow fleet” is also cause for

ness of the G7 cap,” says Brooks. concern going forward, according to IIF, as it

A central issue is compliance with the cap, affords Russia the means to export oil outside the

even if the $60 level has not currently been G7 price cap mechanism. Greek shippers have

breached, says Brooks. “Given the legal and been particularly co-operative with Russia and

reputational damage that comes with violating increased their share of oil carried from 35% pre-

the G7 cap, our assumption is that virtually all war to some 55% now. Moreover, Greek shipping

Western-owned oil tankers operate under the G7 companies have been selling their oldest tankers

price cap mechanism,” Brooks adds. to Russia bolstering its shadow fleet capacity.

On average, Western-owned ships constitute “One avenue Western policy makers may

around 50% of Russian seaborne crude, but there want to explore is a ban on the sale of West-

is wide variation across key exit points from ern-owned oil tankers to Russia, to prevent the

Russia, according to IIF. Compliance is likely shadow fleet from growing further,” says Brooks.

P6 www. NEWSBASE .com Week 06 07•February•2023