Page 8 - FSUOGM Week 25 2022

P. 8

FSUOGM COMMENTARY FSUOGM

Caption Caption

Caption Caption

Caption Caption

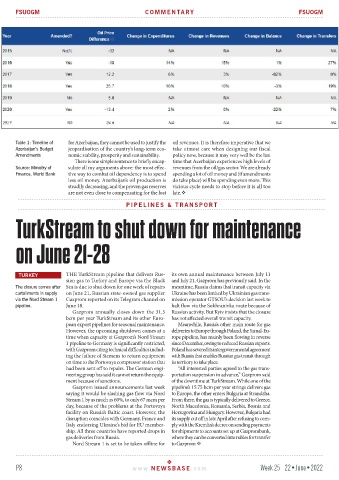

Table 1: Timeline of for Azerbaijan, they cannot be used to justify the oil revenues. It is therefore imperative that we

Azerbaijan’s Budget jeopardisation of the country’s long-term eco- take utmost care when designing our fiscal

Amendments nomic stability, prosperity and sustainability. policy now, because it may very well be the last

There is one simple sentence to briefly encap- time that Azerbaijan experiences high levels of

Source: Ministry of sulate all my arguments above: the most effec- revenues from the oil/gas sector. We are already

Finance, World Bank tive way to combat oil dependency is to spend spending a lot of oil money and (if amendments

less oil money. Azerbaijan’s oil production is do take place) will be spending even more. This

steadily decreasing, and the proven gas reserves vicious cycle needs to stop before it is all too

are not even close to compensating for the lost late.

PIPELINES & TRANSPORT

TurkStream to shut down for maintenance

on June 21-28

TURKEY THE TurkStream pipeline that delivers Rus- its own annual maintenance between July 11

sian gas to Turkey and Europe via the Black and July 21, Gazprom has previously said. In the

The closure comes after Sea is due to shut down for one week of repairs meantime, Russia claims that transit capacity via

curtailments in supply on June 21, Russian state-owned gas supplier Ukraine has been limited by Ukrainian gas trans-

via the Nord Stream 1 Gazprom reported on its Telegram channel on mission operator GTSOU’s decision last week to

pipeline. June 18. halt flow via the Sokhranivka route because of

Gazprom annually closes down the 31.5 Russian activity. But Kyiv insists that the closure

bcm per year TurkStream and its other Euro- has not affected overall transit capacity.

pean export pipelines for seasonal maintenance. Meanwhile, Russia’s other main route for gas

However, the upcoming shutdown comes at a deliveries to Europe through Poland, the Yamal-Eu-

time when capacity at Gazprom’s Nord Stream rope pipeline, has mainly been flowing in reverse

1 pipeline to Germany is significantly restricted, since December, owing to reduced Russian exports.

with Gazprom citing technical difficulties includ- Poland has severed its intergovernmental agreement

ing the failure of Siemens to return equipment with Russia that enables Russian gas transit through

on time to the Portovaya compressor station that its territory to take place.

had been sent off to repairs. The German engi- “All interested parties agreed to the gas trans-

neering group has said it cannot return the equip- portation suspension in advance,” Gazprom said

ment because of sanctions. of the downtime at TurkStream. While one of the

Gazprom issued announcements last week pipeline’s 15.75 bcm per year strings delivers gas

saying it would be slashing gas flow via Nord to Europe, the other enters Bulgaria at Strandzha.

Stream 1 by as much as 60%, to only 67 mcm per From there, the gas is typically delivered to Greece,

day, because of the problems at the Portovaya North Macedonia, Romania, Serbia, Bosnia and

facility on Russia’s Baltic coast. However, the Herzegovina and Hungary. However, Bulgaria had

disruption coincides with Germany, France and its supply cut off in late April after refusing to com-

Italy endorsing Ukraine’s bid for EU member- ply with the Kremlin’s decree on sending payments

ship. All three countries have reported drops in for shipments to accounts set up at Gazprombank,

gas deliveries from Russia. where they can be converted into rubles for transfer

Nord Stream 1 is set to be taken offline for to Gazprom

P8 www. NEWSBASE .com Week 25 22•June•2022