Page 9 - MEOG Week 15 2021

P. 9

MEOG PROJECTS & COMPANIES MEOG

Jordan to re-offer blocks

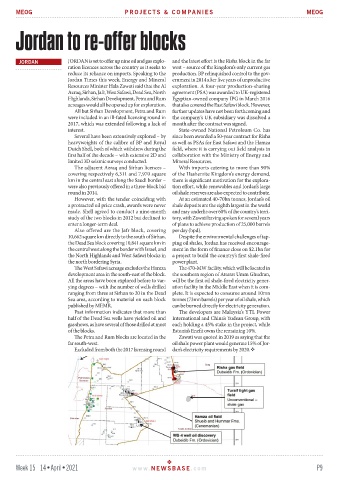

JORDAN JORDAN is set to offer up nine oil and gas explo- and the latest effort is the Risha block in the far

ration licences across the country as it seeks to west – source of the kingdom’s only current gas

reduce its reliance on imports. Speaking to the production. BP relinquished control to the gov-

Jordan Times this week, Energy and Mineral ernment in 2014 after five years of unproductive

Resources Minister Hala Zawati said that the Al exploration. A four-year production-sharing

Azraq, Sirhan, Jafr, West Safawi, Dead Sea, North agreement (PSA) was awarded to UK-registered

Highlands, Sirhan Development, Petra and Rum Egyptian-owned company IPG in March 2016

acreages would all be opened up for exploration. that also covered the East Safawi block. However,

All but Sirhan Development, Petra and Rum further updates have not been forthcoming and

were included in an ill-fated licensing round in the company’s UK subsidiary was dissolved a

2017, which was extended following a lack of month after the contract was signed.

interest. State-owned National Petroleum Co. has

Several have been extensively explored – by since been awarded a 50-year contract for Risha

heavyweights of the calibre of BP and Royal as well as PSAs for East Safawi and the Hamza

Dutch Shell, both of which withdrew during the field, where it is carrying out field analysis in

first half of the decade – with extensive 2D and collaboration with the Ministry of Energy and

limited 3D seismic surveys conducted. Mineral Resources.

The adjacent Azraq and Sirhan licences – With imports catering to more than 90%

covering respectively 6,311 and 7,970 square of the Hashemite Kingdom’s energy demand,

km in the central east along the Saudi border – there is significant motivation for the explora-

were also previously offered in a three-block bid tion effort, while renewables and Jordan’s large

round in 2014. oil shale reserves are also expected to contribute.

However, with the tender coinciding with At an estimated 40-70bn tonnes, Jordan’s oil

a protracted oil price crash, awards were never shale deposits are the eighth largest in the world

made. Shell agreed to conduct a nine-month and may underlie over 60% of the country’s terri-

study of the two blocks in 2012 but declined to tory, with Zawati having spoken for several years

enter a longer-term deal. of plans to achieve production of 25,000 barrels

Also offered are the Jafr block, covering per day (bpd).

10,662 square km directly to the south of Sirhan, Despite the environmental challenges of tap-

the Dead Sea block covering 10,841 square km in ping oil shales, Jordan has received encourage-

the central west along the border with Israel, and ment in the form of finance close on $2.1bn for

the North Highlands and West Safawi blocks in a project to build the country’s first shale-fired

the north bordering Syria. power plant.

The West Safawi acreage excludes the Hamza The 470-MW facility, which will be located in

development area in the south-east of the block. the southern region of Attarat Umm Ghudran,

All the areas have been explored before to var- will be the first oil shale-fired electricity gener-

ying degrees – with the number of wells drilled ation facility in the Middle East when it is com-

ranging from three at Sirhan to 20 in the Dead plete. It is expected to consume around 10mn

Sea area, according to material on each block tonnes (73mn barrels) per year of oil shale, which

published by MEMR. can be burned directly for electricity generation.

Past information indicates that more than The developers are Malaysia’s YTL Power

half of the Dead Sea wells have yielded oil and International and China’s Yudean Group, with

gas shows, as have several of those drilled at most each holding a 45% stake in the project, while

of the blocks. Estonia’s Enefit owns the remaining 10%.

The Petra and Rum blocks are located in the Zawati was quoted in 2019 as saying that the

far south-west. oil shale power plant would generate 15% of Jor-

Excluded from both the 2017 licensing round dan’s electricity requirements by 2020.

Week 15 14•April•2021 www. NEWSBASE .com P9