Page 8 - LatAmOil Week 27 2021

P. 8

LatAmOil MEXICO LatAmOil

Despite these reassurances, the fire has caught fuel extractivist model” applied to the Mexican

the attention of activists around the world. economy. “It will be necessary to see how big the

Photographs and videos showing Pemex’s fire- impact was on the surrounding marine ecosys-

fighting vessels attempting to douse the flames tem,” said Gustavo Amupgnani, the executive

erupting from the sea led a number of promi- director of the organisation.

nent environmental advocates, including cli- Data from Mexico’s Secretariat of Energy

mate striker Greta Thunberg, to call for a halt (SENER) show that Ku-Maloob-Zaap is cur-

to hydrocarbon exploration and development. rently producing about 700,000 barrels per day

Similarly, the head of the Mexican arm of (bpd) of oil, equivalent to about 40% of Pemex’s

Greenpeace said that the blaze highlighted the total output. The field is mature, and it has seen

safety and environmental hazards of the “fossil yields decline in recent years.

TRINIDAD AND TOBAGO

TTNGL says it avoided losses in 2020

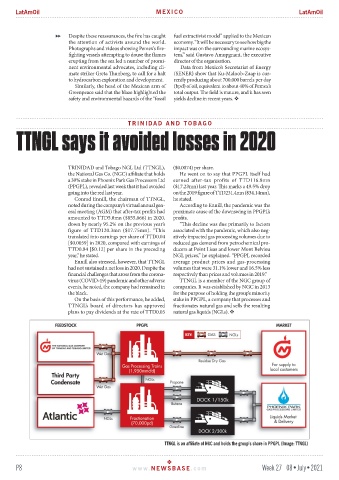

TRINIDAD and Tobago NGL Ltd (TTNGL), ($0.0074) per share.

the National Gas Co. (NGC) affiliate that holds He went on to say that PPGPL itself had

a 39% stake in Phoenix Park Gas Processors Ltd earned after-tax profits of TTD116.8mn

(PPGPL), revealed last week that it had avoided ($17.23mn) last year. This marks a 49.5% drop

going into the red last year. on the 2019 figure of TTD231.4mn ($34.14mn),

Conrad Ennill, the chairman of TTNGL, he stated.

noted during the company’s virtual annual gen- According to Ennill, the pandemic was the

eral meeting (AGM) that after-tax profits had proximate cause of the downswing in PPGPL’s

amounted to TTD5.8mn ($855,666) in 2020, profits.

down by nearly 95.2% on the previous year’s “This decline was due primarily to factors

figure of TTD120.3mn ($17.75mn). “This associated with the pandemic, which also neg-

translated into earnings per share of TTD0.04 atively impacted gas processing volumes due to

[$0.0059] in 2020, compared with earnings of reduced gas demand from petrochemical pro-

TTD0.84 [$0.12] per share in the preceding ducers at Point Lisas and lower Mont Belvieu

year,” he stated. NGL prices,” he explained. “PPGPL recorded

Ennill also stressed, however, that TTNGL average product prices and gas-processing

had not sustained a net loss in 2020. Despite the volumes that were 31.1% lower and 16.5% less

financial challenges that arose from the corona- respectively than prices and volumes in 2019.”

virus (COVID-19) pandemic and other adverse TTNGL is a member of the NGC group of

events, he noted, the company had remained in companies. It was established by NGC in 2013

the black. for the purpose of holding the group’s minority

On the basis of this performance, he added, stake in PPGPL, a company that processes and

TTNGL’s board of directors has approved fractionates natural gas and sells the resulting

plans to pay dividends at the rate of TTD0.05 natural gas liquids (NGLs).

TTNGL is an affiliate of NGC and holds the group’s share in PPGPL (Image: TTNGL)

P8 www. NEWSBASE .com Week 27 08•July•2021