Page 10 - MEOG Week 28 2021

P. 10

MEOG PROJECTS & COMPANIES MEOG

Leviathan partners expedite

expansion drilling plan

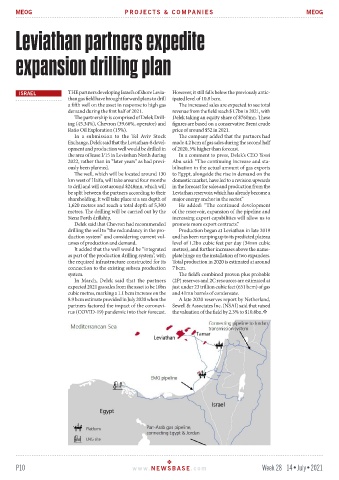

ISRAEL THE partners developing Israel’s offshore Levia- However, it still falls below the previously antic-

than gas field have brought forward plans to drill ipated level of 10.8 bcm.

a fifth well on the asset in response to high gas The increased sales are expected to see total

demand during the first half of 2021. revenue from the field reach $1.7bn in 2021, with

The partnership is comprised of Delek Drill- Delek taking an equity share of $760mn. These

ing (45.34%), Chevron (39.66%, operator) and figures are based on a conservative Brent crude

Ratio Oil Exploration (15%). price of around $52 in 2021.

In a submission to the Tel Aviv Stock The company added that the partners had

Exchange, Delek said that the Leviathan-8 devel- made 4.2 bcm of gas sales during the second half

opment and production well would be drilled in of 2020, 5% higher than forecast.

the area of lease I/15 in Leviathan North during In a comment to press, Delek’s CEO Yossi

2022, rather than in “later years” as had previ- Abu said: “The continuing increase and sta-

ously been planned. bilisation in the actual amount of gas exports

The well, which will be located around 130 to Egypt, alongside the rise in demand on the

km west of Haifa, will take around four months domestic market, have led to a revision upwards

to drill and will cost around $248mn, which will in the forecast for sales and production from the

be split between the partners according to their Leviathan reservoir, which has already become a

shareholding. It will take place at a sea depth of major energy anchor in the sector.”

1,620 metres and reach a total depth of 5,300 He added: “The continued development

metres. The drilling will be carried out by the of the reservoir, expansion of the pipeline and

Stena Forth drillship. increasing export capabilities will allow us to

Delek said that Chevron had recommended promote more export contracts.”

drilling the well to “the redundancy in the pro- Production began at Leviathan in late 2019

duction system” and considering current vol- and has been ramping up to its predicted plateau

umes of production and demand. level of 1.2bn cubic feet per day (34mn cubic

It added that the well would be “integrated metres), and further increases above the name-

as part of the production drilling system”, with plate hinge on the installation of two expanders.

the required infrastructure constructed for its Total production in 2020 is estimated at around

connection to the existing subsea production 7 bcm.

system. The field’s combined proven plus probable

In March, Delek said that the partners (2P) reserves and 2C resources are estimated at

expected 2021 gas sales from the asset to be 10bn just under 23 trillion cubic feet (651 bcm) of gas

cubic metres, marking a 1.1 bcm increase on the and 41mn barrels of condensate.

8.9 bcm estimate provided in July 2020 when the A late 2020 reserves report by Netherland,

partners factored the impact of the coronavi- Sewell & Associates Inc. (NSAI) said that raised

rus (COVID-19) pandemic into their forecast. the valuation of the field by 2.3% to $10.8bn.

P10 www. NEWSBASE .com Week 28 14•July•2021