Page 6 - FSUOGM Week 03 2023

P. 6

FSUOGM COMMENTARY FSUOGM

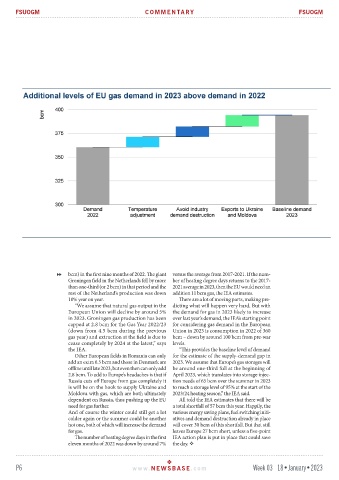

bcm) in the first nine months of 2022. The giant versus the average from 2017-2021. If the num-

Groningen field in the Netherlands fell by more ber of heating degree days returns to the 2017-

than one-third (or 2 bcm) in that period and the 2021 average in 2023, then the EU would need an

rest of the Netherland’s production was down addition 11 bcm gas, the IEA estimates.

10% year on year. There are a lot of moving parts, making pre-

“We assume that natural gas output in the dicting what will happen very hard. But with

European Union will decline by around 5% the demand for gas in 2023 likely to increase

in 2023. Groningen gas production has been over last year’s demand, the IEA’s starting point

capped at 2.8 bcm for the Gas Year 2022/23 for considering gas demand in the European

(down from 4.5 bcm during the previous Union in 2023 is consumption in 2022 of 360

gas year) and extraction at the field is due to bcm – down by around 100 bcm from pre-war

cease completely by 2024 at the latest,” says levels.

the IEA. “This provides the baseline level of demand

Other European fields in Romania can only for the estimate of the supply-demand gap in

add an extra 0.5 bcm and those in Denmark are 2023. We assume that Europe’s gas storages will

offline until late 2023, but even then can only add be around one-third full at the beginning of

2.8 bcm. To add to Europe’s headaches is that if April 2023, which translates into storage injec-

Russia cuts off Europe from gas completely it tion needs of 65 bcm over the summer in 2023

is will be on the hook to supply Ukraine and to reach a storage level of 95% at the start of the

Moldova with gas, which are both ultimately 2023/24 heating season,” the IEA said.

dependent on Russia, thus pushing up the EU All told the IEA estimates that there will be

need for gas further. a total shortfall of 57 bcm this year. Happily, the

And of course the winter could still get a lot various energy saving plans, fuel switching initi-

colder again or the summer could be another atives and demand destruction already in place

hot one, both of which will increase the demand will cover 30 bcm of this shortfall. But that still

for gas. leaves Europe 27 bcm short, unless a five-point

The number of heating degree days in the first IEA action plan is put in place that could save

eleven months of 2022 was down by around 7% the day.

P6 www. NEWSBASE .com Week 03 18•January•2023