Page 11 - MEOG Week 28 2022

P. 11

MEOG TENDERS MEOG

Bidding process begins for EastMed gas line

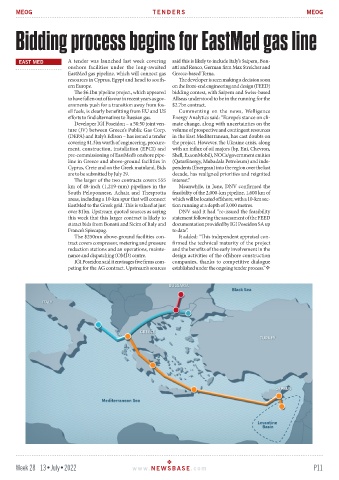

EAST MED A tender was launched last week covering said this is likely to include Italy’s Saipem, Bon-

onshore facilities under the long-awaited atti and Renco, German firm Max Streicher and

EastMed gas pipeline, which will connect gas Greece-based Terna.

resources in Cyprus, Egypt and Israel to south- The developer is seen making a decision soon

ern Europe. on the front-end engineering and design (FEED)

The $6.1bn pipeline project, which appeared bidding contest, with Saipem and Swiss-based

to have fallen out of favour in recent years as gov- Allseas understood to be in the running for the

ernments push for a transition away from fos- $2.7bn contract.

sil fuels, is clearly benefitting from EU and US Commenting on the news, Welligence

efforts to find alternatives to Russian gas. Energy Analytics said: “Europe’s stance on cli-

Developer IGI Poseidon – a 50:50 joint ven- mate change, along with uncertainties on the

ture (JV) between Greece’s Public Gas Corp. volume of prospective and contingent resources

(DEPA) and Italy’s Edison – has issued a tender in the East Mediterranean, has cast doubts on

covering $1.3bn worth of engineering, procure- the project. However, the Ukraine crisis, along

ment, construction, installation (EPCI) and with an influx of oil majors (bp, Eni, Chevron,

pre-commissioning of EastMed’s onshore pipe- Shell, ExxonMobil), NOCs/government entities

line in Greece and above-ground facilities in (QatarEnergy, Mubadala Petroleum) and inde-

Cyprus, Crete and on the Greek mainland. Bids pendents (Energean) into the region over the last

are to be submitted by July 29. decade, has realigned priorities and reignited

The larger of the two contracts covers 555 interest.”

km of 48-inch (1,219-mm) pipelines in the Meanwhile, in June, DNV confirmed the

South Peloponnese, Achaia and Thesprotia feasibility of the 2,000-km pipeline, 1,600 km of

areas, including a 10-km spur that will connect which will be located offshore, with a 10-km sec-

EastMed to the Greek grid. This is valued at just tion running at a depth of 3,000 metres.

over $1bn. Upstream quoted sources as saying DNV said it had “re-issued the feasibility

this week that this larger contract is likely to statement following the assessment of the FEED

attract bids from Bonatti and Sicim of Italy and documentation provided by IGI Poseidon SA up

France’s Spiecapag. to date”.

The $250mn above-ground facilities con- It added: “This independent appraisal con-

tract covers compressor, metering and pressure firmed the technical maturity of the project

reduction stations and an operations, mainte- and the benefits of the early involvement in the

nance and dispatching (OMD) centre. design activities of the offshore construction

IGI Poseidon said it envisages five firms com- companies, thanks to competitive dialogue

peting for the AG contract. Upstream’s sources established under the ongoing tender process.”

Week 28 13•July•2022 www. NEWSBASE .com P11